If You Owe State Taxes Can They Suspend Your License?

Yes, if you owe state taxes, the state may suspend your driver’s or professional license — but the good news is that you can get it back.

How State Licensing Revocation Works

Although the process varies from state to state, the typical process looks like this:

1. State Revocation Threshold Triggered

The process begins with the state noticing — sometimes manually and sometimes systemically — that the taxpayer has an assessed balance (usually in excess of some threshold amount):

- that is not currently in a resolution (such as an installment agreement) and

- for which the taxpayer has exhausted all protest and appeal rights OR the state notices that the taxpayer has not filed a required tax return.

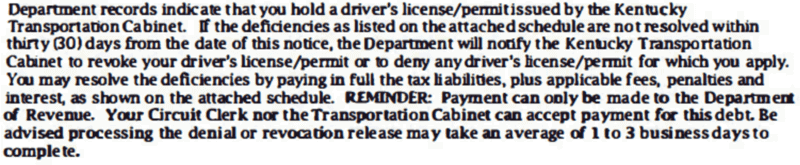

2. State Revenue Department Notice to Taxpayer

The state revenue department will then notify the taxpayer (usually via certified mail) of their existing tax deficiencies and that due to these deficiencies the taxpayer’s information will shortly be submitted to the licensing agency for revocation or suspension of their license.

Often, this notice will include a deadline (such as 20 days or 30 days) for the taxpayer to resolve their existing tax deficiencies before the state revenue department makes the submission of the taxpayer’s information to the appropriate licensing agency.

3. State Revenue Department Notice to Licensing Agency

If the issues in the notice the state revenue department sent to the taxpayer are not resolved between the taxpayer and the state revenue department within the department’s specified timeframe, the state revenue department will submit the taxpayer’s information to the appropriate licensing agency for license revocation or suspension.

4. Suspension or Revocation by Licensing Agency

The licensing agency will then revoke or suspend the taxpayer’s license and will then send a notice to the taxpayer informing them of this revocation.

How We Got Our Client’s License Back

As mentioned previously in this article, we had a client in Kentucky whose license had been revoked due to taxes owed to the state.

1. We contacted the state.

Since our client had signed a state tax power of attorney giving us the authority to discuss his tax matter with the state, we called the state revenue department and negotiated a deal for him to get his license back.

2. We negotiated a deal with the state.

We went back and forth with the state quite a bit, but we were eventually able to negotiate a one-time payment of $150 that, if made by the taxpayer, would cause the department of revenue to give the “green light” to the state licensing agency to release our client’s driver’s license.

3. Our client contacted the licensing agency to get his license back.

After we “cleared” the client’s license with the state revenue department, our client then had to contact the licensing agency to get his license back.

He had to pay a small reinstatement fee of $40 — this amount will vary from state to state — but he was back on the road again in no time!