What Is Tax Relief and How Does It Work?

Tax relief is a general term used to describe various programs that taxpayers and their representatives — such as tax attorneys and CPAs — utilize to minimize or even eliminate the taxes, penalties, and interest a taxpayer owes to the IRS and other tax agencies.

These tax relief programs range from a simple phone call to the government for first-time penalty abatement to a full-fledged offer in compromise.

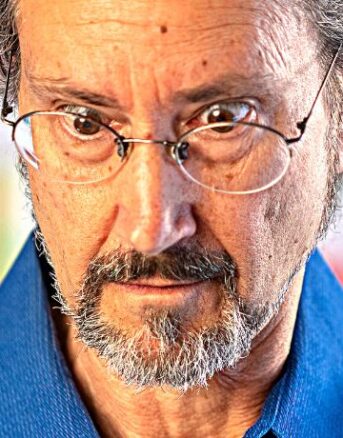

Who am I? I’m Logan Allec, CPA, founder of Choice Tax Relief and one of the most sought-after tax relief CPAs in the country.

Table of Contents

How Tax Relief Works

While every tax relief program is different, there are some commonalities among various tax relief programs, such as:

- The more compliant you have been with the government — filing your required tax returns, making an effort to pay what you can, etc. — the more likely the government is to work with you on your tax debt.

- The less you have in terms of income and assets to pay the government, the more options you may have available to you to wipe away your tax debt.

- The older your tax debt, the more likely it is that you will be able to secure a favorable tax relief program. This is because tax debt is generally subject to a statute of limitations, which is a time limit on how long a taxing authority has to assess or collect a tax debt. This is not to say that if your tax debt is fresh that you can’t utilize one of these programs — we do this for our clients with new tax debt every day — it’s just that all else being equal, the IRS is more willing to forgive old tax debt than new tax debt.

The Three Major Kinds of Tax Relief

This article will serve as your guide to learning about the three major tax relief options available to you:

And don’t sleep on that last one, folks — in some taxpayers’ situations, getting in currently not collectible status is superior to getting an offer in compromise accepted, and I’ll tell you why in this article.

And don’t write off installment agreements either.

I’m not talking about the full-pay installment agreements that the IRS will push you into if you set up a plan online or you call them up.

I’m talking about special kinds of installment agreements where you or a tax professional make a case to the IRS using special IRS forms that you cannot afford to fully pay your balance but that you can afford to pay part of your balance in monthly installments until the 10-year statute of limitations on collections expires.

So even if you owe the IRS $300,000, and there’s three years left in your statute, if we can convince them that you can really only afford to pay $100 a month under a partial-pay installment agreement, and there’s only three years left in the statute, well, you’re only paying the IRS in total $3,600 on a $100,000 debt.

This is the one good thing that came out of the George W. Bush administration, people.

Snuck in Section 843(a)(b)(B) of the American Jobs Creation Act of 2004, it says, “by inserting ‘full or partial’ after facilitate.”

This means that the IRS must accept installment agreements even if the sum payments under that installment agreement before the taxpayer’s statute closes will not satisfy the taxpayer’s entire debt.

Because you call the IRS up right now to set up an installment agreement, they’ll put you in one that you probably can’t afford because they want you to pay off your entire balance.

But there are these hardship-based installment agreements the IRS won’t tell you about over the phone and that will take some work to make your case to the IRS why you shouldn’t have to pay them your entire tax due, but that’s why I’m here, and we’ll talk about it.

So in this article I’m talking about offers in compromise, currently not collectible status, and installment agreements.

Now, there are other tax relief programs and actions taxpayers can utilize such as penalty abatement, innocent spouse relief, filing your back taxes to reduce your balance because the IRS filed a substitute for return (SFR) for you — I recently covered back taxes in another article — and other strategies, but these are the big ones: OICs, CNCs, and IAs, specifically PPIAs, or partial-pay installment agreements.

Choose Your Tax Relief Company Carefully

And when you’re pursuing tax relief or when your tax professional is pursuing tax relief for you on your behalf, it’s important that all of these options be considered.

I’m not going to name names because I can’t do that, but there are tax relief companies out there that shuffle people into offers in compromise because they can charge more for an offer in compromise because that’s the one where you can settle your tax debt for less than you owe, which makes it a fairly easy sale for the non-licensed, non-tax-professional, commission-based salespeople on the tax relief company’s sales floor.

What they don’t tell you, however, is:

- Most taxpayers do not qualify for an offer in compromise, especially if they have appreciated assets such as equity in real estate.

- Other tax relief options are likely more attainable than an offer in compromise for many taxpayers, including those who have equity in assets, and sometimes these other options are superior to an offer in compromise — not all the time, but sometimes.

You can read on the Federal Trade Commission’s website all about shady tax relief companies, but that is not how my company Choice Tax Relief operates.

When you have your initial consultation with Choice Tax Relief, it is with a credentialed tax professional — a CPA, an enrolled agent, or an attorney — not with an unlicensed, commission-based salesperson who will say just about anything to make the sale. And schedule permitting, I do my best to make these calls as well.

If you’ve been through that rodeo before with some of the bigger tax relief shops or if you’ve even just read online reviews of some of these tax relief companies, you know exactly what I’m talking about when it comes to their sales tactics.

Offer in Compromise

An offer in compromise is an agreement between a taxpayer and a taxing authority — such as the IRS — to settle the taxpayer’s tax debt for less than they owe.

And with the most commonly submitted offers in compromise, the amount you pay has more to do with what you have than with what you owe.

So when you hear about the stories of people — and I’ve had clients like this; they don’t come along very often — but when you hear the stories of people who settle their $300,000 tax debt for $3,000 or $300, that’s an offer in compromise.

IRS Offer in Compromise

There are three kinds of offers in compromise the IRS accepts:

- Doubt As to Collectibility: This offer in compromise is by far the most popular one submitted to and accepted by the IRS. With a doubt as to collectibility offer in compromise, the taxpayer is making a case to the IRS, based on their own financials, that they cannot afford to pay all or some of their tax debt. Based on the offer in compromise formula, the taxpayer submits their settlement offer to the IRS, and the IRS will either accept or reject it. Note that the actual process is often a lot more complicated than this, involving a lot of back-and-forth between the taxpayer (or their representative) and an IRS offer examiner.

- Doubt As to Liability: This offer in compromise involves the taxpayer proving to the IRS that they do not actually owe all or some of the amount of tax the IRS claims they do.

- Effective Tax Administration: This is a very rare kind of offer in compromise that involves the taxpayer showing that, even though they owe the tax and can afford to pay it, it would be unfair or against public policy for the IRS to make them pay it.

If you’d like to learn more about each of these different types of offers in compromise, be sure to read this article.

State Offer in Compromise

Many states have their own offer in compromise programs.

These programs will generally have similar rules as the IRS’s offer in compromise program, but in my experience the states tend to be a bit more restrictive and nit-picky about their offers.

For example, one thing you have to know about an offer in compromise is that it is a legally binding contract you make with the state or federal government, and a legally-binding contract requires offer, consideration, and acceptance.

So there must be consideration: You must offer something to the government in this exchange, even if it’s just a dollar.

And if you’ve read my lengthy article on exactly how much to offer in compromise to the IRS with a doubt as to collectibility offer, you know that with an IRS offer in compromise, you can either pay your offer amount in five or fewer payments within five months or less or you can pay your offer in full in six to 24 months with the former option requiring less money out of pocket and the latter requiring more money out of pocket.

But here in California, for example, if you look at the Form 4905 PIT in Section 9, your only option is to make a lump sum offer to the FTB. But the good news is that you don’t have to send anything with your offer; you would only have to pay this lump sum if your offer was accepted.

The same is true is South Carolina — we just helped someone in South Carolina — and South Carolina says that after your South Carolina offer is accepted you have 30 days to pay your offer amount.

But some states are more lenient. Vermont, for example — we have an offer pending right now with the Vermont Department of Taxes — Vermont is willing to go up to 36 months.

So there’s not a hard and fast rule with the states; each one is different; but if you have a qualified professional in your corner such as our lovely staff of tax professionals at Choice Tax Relief where we have experience working with clients across the country, we know and research all these rules in assisting our clients with their back taxes.

That said, even with the best tax professional in your corner, states are by and large often much more reluctant to accept an offer in compromise than the IRS is.

There are obviously budgetary reasons for that, but in addition to that because some states’ statute of limitations on collections is longer than the IRS’s statute — California, for example, has a 20-year statute compared to the IRS’s 10-year statute — some states may simply reject an offer in compromise because they still have so many more years from which they can collect from the taxpayer.

Alright, that’s enough about offers in compromise; I have other content on this site that goes much more in depth on offers in compromise, and you can check that information out at your convenience.

Now let’s talk about another tool in the tax relief toolbox, and that is getting in currently not collectible status.

Currently Not Collectible (CNC) Status

Currently not collectible status is exactly what it sounds like: If you or your tax professional successfully convince the IRS that it would not be reasonable for them to expect you to pay both the taxes you owe the IRS as well as your basic living expenses, the IRS will place you in currently not collectible — or “CNC” — status, and the IRS is will not attempt to collect taxes from you as long as you are in this status.

So let’s say you owe the IRS back taxes. It won’t be long before the IRS takes collection action on your account by garnishing your wages (up to a certain amount), levying your bank account, or taking your Social Security payments. Yes, the IRS can take up to 15% of your Social Security payment automatically through the Federal Payment Levy Program; they can take more than 15% manually, but they can only take up to 15% through the automatic levy.

And there are other collection activities that the IRS can take, but this is all to say that the IRS is the nation’s largest and most powerful collection agency, and it has pretty spectacular powers when it comes to taking things from delinquent taxpayers to satisfy their tax debts.

The Benefits of CNC Status

But if you can get in CNC status, then the IRS is prohibited by law from taking collection action against you, and you are not required to make payments as long as you are in CNC status.

Another beautiful thing about CNC status is what while you are in CNC status, the 10-year statute of limitations on collection activities that I’ve talked about in other videos keeps running.

The IRS has 10 years from the date it assesses a tax to collect it. However, there are things and events that can toll the statute of limitations, meaning pause it for a time, and typically, if the IRS can’t take collection activities against somebody, the collections statute is tolled during that time period.

However, this is not the case with CNC status. So one strategy we like to look at for our clients — especially if we’re closing in in the next few years on the ten-year statute of limitations on collections — is getting the taxpayer in CNC status and just run the statute of limitations out.

What’s the end result here? The statute of limitations on collections has run out, so the government no longer has a right to pursue collection of that tax liability — forever!

And here’s the kicker: The taxpayer did not have to pay the IRS a cent.

You see why currently not collectible status might be better than an offer in compromise? Because remember what I said before — with an offer in compromise, you’re going to have to pay the IRS something.

And rarely is it some nominal amount like a dollar; how much you have to pay the IRS is based on various calculations that I’ve gone over in a previous article on calculating how much to offer to the IRS in an offer in compromise.

But there is none of that while you’re in CNC status; unlike the offer in compromise and unlike the installment agreement, the taxpayer has no obligation to pay the IRS to get in CNC status.

CNC Status Downsides

Now, there are a few things you should know about CNC status:

- Penalties and Interest: The first thing to keep in mind is that penalties and interest will continue to accrue on your debt while you are in CNC status. That’s not all that bad though because they would accrue anyway when the IRS was on your back; now, they’re accruing without the IRS on your back. So that’s just something to know.

- Not Guaranteed: Getting in CNC status is not guaranteed; you or your representative must proactively seek it! The IRS will need to review your financial situation — typically using Form 433-A or Form 433-F (or Form 433-B if you’re a business) and any requested documentation — in order to approve placing you in CNC status.

- Not Perpetual: CNC status does not last forever. Eventually, the IRS will want to take another look at your situation to ensure that you still qualify for CNC status. So typically they do an annual review of the taxpayer’s income. If you file a tax return showing, for example, that you made a lot more income than you did when applying for CNC status, that could trigger the IRS to remove you from CNC status.

- Not Lien-Proof: Even if you are in CNC status, the IRS may still file a Notice of Federal Tax Lien against you. (A federal tax lien is the IRS’s legal claim to your property to pay your tax debt.)

That said, as I mentioned previously, being placed in CNC status stops IRS collection activities such as wage garnishments and bank levies, and the IRS’s time limit to collect taxes from — the statute of limitations on collections — continues to run while you are in CNC status, so it can be real benefit to taxpayers.

Installment Agreement

An installment agreement — also known as a payment plan — is an agreement between a taxpayer and a taxing authority to pay their taxes, penalties, and interest over a certain period of time.

Full-Pay Installment Agreements

And like I mentioned previously, the IRS loves what are called full-pay installment agreements. These are payment plans where you are basically paying the entire balance that you owe to the IRS over 120 days or three years or six years or something like that.

And these full-pay installment agreements are super easy to set up with the IRS because the IRS loves them. In fact, if you Google, “What if I can’t pay my taxes?” the first search result that comes up is an article from irs.gov that says:

“What if I can’t pay my taxes? Don’t panic — you may qualify for a self-service, online payment plan (including an installment agreement) that allows you to pay off an outstanding balance over time. Once your online application is complete, you’ll receive immediate notification of whether your payment plan has been approved without having to call or write to the IRS.”

And then it lists out the two kinds of payment plans you can get online:

- Short-term payment plan: If you owe less than $100,000 in combined taxes, penalties, and interest, and you can pay your balance off within 120 days, you can go with this option. And these short-term, 120-day plans are not technically “installment agreements” because you are not required to pay in installments. You can pay this off all at once or as often as you like as long as payment of your full balance is made within 120 days.

- Long-term payment plan: 120 days is a very short span of time, so if you owe less than $50,000 in combined taxes, penalties, and interest, then you can make monthly payments under a full-pay installment agreement.

So the IRS wants to make it easy for people to get into these full-pay installment agreements. And if you owe the IRS $50,000 or more, you can get an installment agreement as well using Form 9465 or by calling the IRS directly.

Partial-Payment Installment Agreements

However, if you have financial hardship, you may qualify for a partial-payment (or hardship-based) installment agreement with the IRS because Internal Revenue Code §6159(a) says, plain as day (emphasis mine), thanks to the American Jobs Creation Act of 2004:

“The Secretary [meaning the Secretary of the Treasury and by extension the Treasury Department and by extension the IRS, which is part of the Treasury Department is authorized to enter into written agreements with any taxpayer under which such taxpayer is allowed to make payment on any tax in installment payments if the Secretary determines that such agreement will facilitate full or partial collection of such liability.”

So if somebody doesn’t qualify for an offer in compromise because maybe they make too much money or they have equity in assets, and they also don’t qualify for currently not collectible status because, well, they can afford to pay something to the IRS every month, then the IRS may accept an installment agreement the sum of whose payments until the collections statute on the taxpayer’s debt expires is less than the taxpayer’s outstanding balance to the IRS.

How do you convince the IRS to accept such an arrangement? It’s all about knowing how to fill out the Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals, and using the IRS’s own Internal Revenue Manual on Partial-Payment Installment Agreements — that’s IRM 5.14.2 — to your advantage.

And this especially rings true to those of you with equity in assets. If you don’t have equity in assets, and you can’t pay the IRS, you have a decent shot at qualifying for an offer in compromise or maybe CNC status.

But if you have equity in assets, an Offer in Compromise will be difficult, and even CNC status might be difficult, especially if you have decent income.

But check out what Internal Revenue Manual §5.14.2.2.2(2)(e) says:

“A PPIA [partial-payment installment agreement] may be granted if a taxpayer does not sell or cannot borrower against assets with equity because…it would impose an economic hardship on the taxpayer to sell property, borrow on equity in property, or use a liquid asset to pay taxes.”

So let’s say you owe the IRS $30,000, but you have a house with $100,000 in equity in it. The name of the game here is showing the IRS and building a case to the IRS that it would impose an economic hardship on you to sell this property to pay your taxes or borrow against your equity in the property.

And a lot of knowing how to do this — how to make the case for a taxpayer — is based on experience.

The IRM has examples of possible situations that would qualify for a partial-payment installment agreement with equity in assets — they use the example of someone on Social Security in the IRM — but there are other situations as well in which we can build a case using the IRS’s own forms such as the Form 433-A to show the IRS and to the group manager (because partial-payment installment agreements do require IRS group manager approval; the phone representative can’t make this call; it needs to go up the chain) that this taxpayer, while they do have the ability to pay something to the IRS, cannot pay the full balance before the statute expires without experiencing economic hardship.

And that’s the name of the game with partial-pay installment agreements.

Tax Relief FAQs

What is the IRS Fresh Start Program?

Contrary to what you may hear in those radio ads, the IRS Fresh Start Program is not some pie-in-the-sky program through which you can settle your tax debt for pennies on the dollar.

Rather, the Fresh Start Program is simply a set of changes the IRS made to its tax collections and relief policies. You can learn more about these changes in our video below.

Does tax relief hurt your credit?

The tax relief options that can be negotiated with the IRS do not hurt your credit. In fact, they do not affect your credit at all.

That said, bankruptcy — which is not an administrative process with the IRS but rather a judicial process through Bankruptcy Court — does negatively affect your credit.

What To Do Now

It’s one thing to understand which tax relief programs are out there for those who owe the IRS or their state.

But it’s another thing to take action.

The IRS isn’t going to tell you which of these options is best for your situation; they may not even tell you about these options at all!

In my experience, the IRS pushes people into full-pay installment agreements; you may have experienced this yourself.

Reach out to us today at 866-8000-TAX if you would like assistance with your tax relief options.