Unfiled Tax Returns: Why They’re a Problem and What To Do About Them

If you have unfiled tax returns, you probably know that you have a problem.

How big a problem? Well, the problem could be as small as missing out on some refunds to which you’re entitled to having an IRS revenue officer show up at your door to being charged with a federal crime under Section 7203 of the tax code.

How Big a Problem Is Having Unfiled Tax Returns?

If you’re a W-2 employee who had a decent amount of taxes taken out of your paycheck every pay period for the years you haven’t filed tax returns for, you may not be looking at too great a tax bill, even considering penalties and interest.

However, if you are a 1099 worker who has unfiled tax returns — watch out! The IRS may prepare a substitute for return (SFR) for you based only on your 1099 income without any expenses and assess tax accordingly.

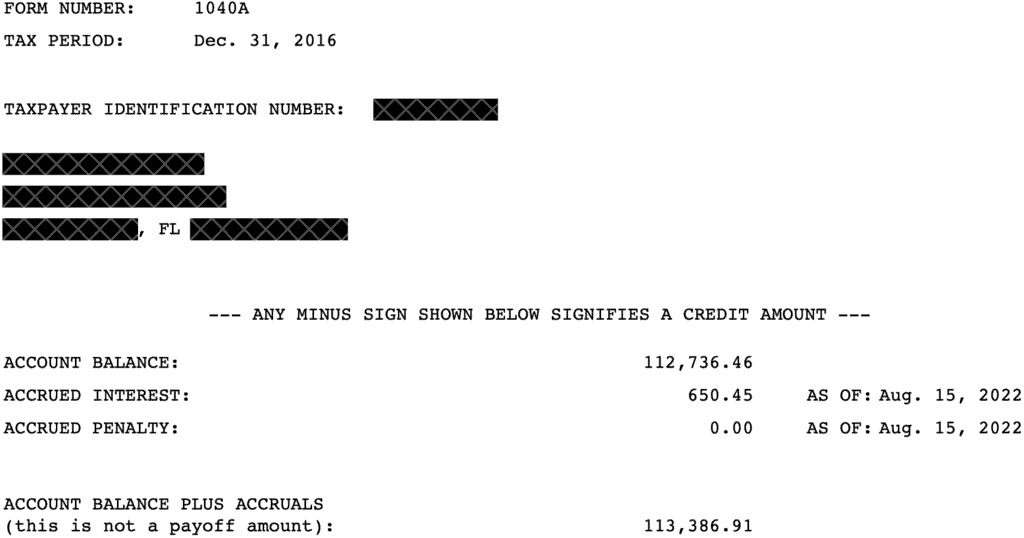

If this happens to you, be prepared for a massive tax bill from the IRS. For example, the account transcript excerpt shown below is from one of our clients who was a 1099 truck driver and had several years of unfiled tax returns.

This excerpt is just for one year — tax year 2016.

The IRS assessed over $113,000 in taxes, penalties, and interest based on this individual’s single Form 1099. (Note that the “accrued interest” and “accrued penalty” amounts in the image above represent only the accrued but not assessed penalties and interest; the already-assessed penalties and interest were over $30,000 for this particular year.)

This taxpayer had other tax years with similar situations when he came to us. Shortly thereafter, a revenue officer was assigned to his case because his balance was over $250,000.

However, once we filed his returns, we got his balance for this year down to less than $10,000!

So we took what was a huge problem due to his unfiled tax returns and made it a much smaller problem simply by filing his tax returns.