IRS SFR (Substitute For Return) Explained by a CPA

An IRS SFR — or substitute for return — is a tax return the IRS files for taxpayers who do not file their own required tax returns.

The IRS has this authority under Internal Revenue Code Section 6020(b)(1), which states:

“If any person fails to make any return required by any internal revenue law or regulation made thereunder at the time prescribed therefor, or makes, willfully or otherwise, a false or fraudulent return, the Secretary shall make such return from his own knowledge and from such information as he can obtain through testimony or otherwise.”

And according to Internal Revenue Manual Section 4.25.8.5(2), the IRS will prepare an SFR for a taxpayer when the tax return due date and extended due date have both passed and all of the IRS efforts to obtain a tax return from the taxpayer have passed.

In this article, I will answer the following questions about IRS SFRs:

- What causes the IRS to file an SFR?

- Who prepares IRS SFRs?

- What does the IRS SFR process look like?

- What should I do if the IRS filed an SFR for me?

- How can I know if the IRS filed an SFR for me?

If you’re behind on your tax return filings — and especially if the IRS has filed an SFR against you or is threatening to do so — watch our video below to learn exactly what to do!

Table of Contents

What Causes the IRS to File an SFR?

Approximately 10 months after a taxpayer’s tax return is due — including the extended due date if the taxpayer filed for an extension — the IRS starts sending notices to the taxpayer’s last-known address letting them know that they should file their tax return.

The typical notice sequence in this case is the CP59, followed by the CP515, then the CP516, and finally the CP518. All of these notices use increasingly stronger language to encourage the taxpayer to file their tax return.

And if the taxpayer does not heed those notices and does not file their required tax return, the IRS may eventually file an SFR for them for the tax year in question.

Who Prepares IRS SFRs?

The actual department within the IRS that prepares SFRs is the IRS Automated Substitute for Return (ASFR) Program.

ASFR Program

In the words of the IRS’ own Internal Revenue Manual Section 5.18.1.2(1), ASFR “is a key compliance program within the [IRS], enforcing compliance for taxpayers who have not filed individual income tax returns, but owe a significant income tax liability.”

So how it works is the ASFR system — which the IRS describes as “a stand-alone system residing on a SUN Microsystems platform at the Enterprise Computing Center” — takes a taxpayer’s W-2 and 1099 and K-1 data and basically do a bunch of calculations to calculate the taxpayer’s income and tax liability, which is essentially the SFR.

ASFR also generates notices, such as Letter 2566, to send to taxpayers informing them that the IRS has prepared an SFR for them.

ASFR Employees

Much of this is process is automated and systemic, but the ASFR Program does have employees in Austin, Texas; Brookhaven, New York; and Fresno, California.

So what do these ASFR employees do? Well, sometimes a particular SFR for a particular year for a particular taxpayer something in the system will flag the SFR for manual review, and an employee in the ASFR Program will manually review that SFR.

Other ASFR employees field responses from taxpayers with respect to SFRs filed for them.

So we don’t know too much about the structure of personnel in the ASFR Program because so much of the work done by the program is done by the computers, but we do know, interestingly enough, that each of the three ASFR Program campus — in Austin, Brookhaven, and Fresno — has a “coordinator” that is responsible for certain kinds of SFR cases that the IRS wants to be “worked expeditiously.”

And these two SFR cases are as follows:

- Cases where there is a mismatch between an income amount reported by a payer and the amount used on an SFR generated by ASFR, in which case the IRS obviously wants to see what’s going on because often that’s just an internal IRS issue

- Cases for which the IRS believes, based on an SFR, the IRS may be able to collect over $100,000 — which sounds like a lot but may not actually be that much when you consider that the IRS loves targeting 1099 earners for SFRs. And when you keep in mind that on SFRs for folks on 1099, the IRS doesn’t give them any business deductions, so if you’re a truck driver — we get a ton of truck drivers as clients who didn’t file their taxes and the IRS filed SFRs against them — who grossed $350,000 top line of a given year, when the IRS does its SFR calculation for you for that year, it will probably come up with a figure for that year of over $100,000 because it’s not giving you any deductions that you would be entitled to if you had filed or do file an original return for that year.

So all this is to say that the IRS does appear to have some prioritization in place when it comes to SFRs and specifically wants to target those who it believes could owe at least six figures in taxes for a given year.

IRS SFR Process

1. IRS ASFR Program Prepares SFR

The IRS process is largely automated; the ASFR Program files SFRs based on income information reported to it by third parties on informational returns such as W-2s, 1099s, and K-1s.

And although the IRS uses this third-party income information to prepare SFRs, it does not use third-party deduction information such as mortgage interest reported on Form 1098.

Also, as mentioned previously, the IRS also does not estimate a taxpayer’s business expenses against any 1099 income reported to them.

So if a taxpayer who has substantial 1099 income fails to file tax returns for several years, the IRS will likely file SFRs for them that significantly overstate the taxpayer’s tax liability because no deductions were taken on the SFR against the taxpayer’s 1099 income.

2. IRS ASFR Program Sends 30-Day Letter

After the IRS ASFR Program prepares the SFR, it sends the taxpayer Letter 2566 — a systemically generated 30-day letter.

Now, there are many kinds of 30-day letters the IRS sends, but the gist of them is that the IRS is proposing to assess a certain amount of taxes, penalties, and interest on the taxpayer, and if the taxpayer does not respond to the letter within 30 days, the IRS will assess the proposed taxes, penalties, and interest accordingly.

So there are many kinds of 30-day letters; for example, if you’ve undergone a mail-based audit and the IRS is proposing certain changes on Form 4549 at the conclusion of the audit, they’ll send you a 30-day letter in the form of Letter 525; if it was an in-person audit, they’ll use a 30-day letter in the form of Letter 915.

And the particular letter that the IRS ASFR Program systemically generates and sends to the taxpayer after preparing an SFR is Letter 2566.

This letter informs the taxpayer of the following things:

- That the IRS did not receive a tax return for the year mentioned in the letter

- That the IRS prepared an SFR for that tax year, computing the taxpayer’s taxes, penalties, and interest based on income reported to the IRS by third parties

- That it is likely to the taxpayer’s advantage to file their original return for the tax year in question

And, because it is a 30-day letter, it says that if the taxpayer does not do one of the following within 30 days, the IRS will assess the proposed taxes, penalties, and interest according to the SFR:

- File their actual return for that year

- Send a statement explaining why they believe they are not required to file or additional information they would like the IRS to consider

- Appeal the proposed assessment

Another option is for the taxpayer to simply agree to the proposed assessment by signing, dating, and mailing back to the IRS the “Consent to Assessment and Collection” form that accompanies Letter 2566.

3. IRS ASFR Program Sends 90-Day Letter

Now, if the taxpayer doesn’t respond to the 30-day letter within 30 days, the IRS doesn’t assess the taxes, penalties, and interest just yet; the taxpayer has an additional 90 days to address the issue as described in the next letter the IRS ASFR Program will send to the taxpayer, which is the 90-day letter.

So if the taxpayer does not respond to the IRS within that 30-day period after the 30-day letter, the IRS will generate a 90-day letter — also known as a Statutory Notice of Deficiency — to the taxpayer via certified mail. Similar to 30-day letters, there are several different kinds of 90-day letters that the IRS sends to taxpayers, but the ASFR Program generally sends the Letter 3219N.

So this notice does eight things:

-

- It explains how the IRS calculated the amount of taxes, penalties, and interest that it believes you owe.

- It informs you that you have the right to challenge the IRS’ determination of taxes, penalties, and interest it believes you owe in Tax Court.

- It starts the clock on your deadline to file this Tax Court petition if you choose to do so, and this is why it’s called a 90-day-letter — because your deadline to file your Tax Court Petition is 90 days from the notice date found at the top-right-hand corner of the 90-day letter itself.

- It informs you that you can still file your original return for the year with the IRS, meaning that while Tax Court is an avenue here for you to contest the IRS’ determination, you can also or in addition to Tax Court file your complete and accurate return, which may reduce your tax liability significantly, and frankly for most folks that’s probably the way to go — just file your original return for the year, which will likely reduce your tax liability significantly without you having to deal with Tax Court.

- It informs you that if you don’t contest the liability determined by the IRS either by filing your return for the tax year in question and/or filing a Tax Court petition within 90 days, the IRS will assess the taxes, penalties, and interest it calculated on your behalf via the SFR process.

- It informs you that you can simply agree to the IRS’ assessments by signing the Response Form that is sent along with the Letter 3219N.

- It informs you that you may be eligible for a payment arrangement with the IRS if you get in tax compliance.

- It gives you the name and contact information for your contact person regarding the IRS’s proposed SFR assessment and the 90-day letter.

Does the IRS Prepare SFRs Outside the ASFR Program?

Yes, though not as common as ASFR-prepared SFRs, IRS tax examiners can manually prepare SFRs.

In this case, you can expect to receive IRS Letter 1862 in the mail rather than IRS Letter 2566, which is exclusively used by the ASFR Program, and you should expect IRS Letter 3219 as your 90-day letter.

If you do not respond, and the IRS assesses taxes, penalties, and interest based on the SFR prepared by the Examinations division, the IRS will then send you Notice CP22E informing you of your balance.

What Should I Do If the IRS Has Filed an SFR For Me?

If the IRS has filed an SFR for you for a given year, you should do two things:

- Determine if it would be in your best interest to file an original return for this year.

- File the original return if doing so is indeed in your best interest.

Here’s how.

1. How to know if filing an original return is in your best interest

In general, it is advisable to file an original return to replace an SFR for any given year, and here are three reasons why:

- Like I mentioned above, SFRs often overstate a taxpayer’s liability because they only consider reported income and standard deductions so therefore filing a return to replace an SFR, which will include additional deductions, often results in a lower tax liability for the year.

- The assessment of tax based on an SFR starts the clock on the IRS’s 10-year collection statute to collect a tax debt. However, it does not start the clock on the IRS’s 3-year statute to assess a tax debt; you have to file an original return to do that.

- Although SFRs are considered “prima facie good and sufficient for all legal purposes” according to Internal Revenue Code Section 6020(b)(2), they do not count as being compliant for the purpose of obtaining first-time abatement for a penalty. If a client qualifies for first-time abatement, except for the filing of the SFR, filing a return for that year would probably make sense. However, this situation is rare as the taxpayer would have had no balance for the SFR year, which is not

On the other hand, there are situations where filing an SFR year for a client may not be necessary, and here are three reasons why:

- Filing a return to replace an SFR could increase the taxpayer’s tax liability for the year, although this is uncommon.

- If the client is a good candidate for an offer in compromise, reducing their liability by filing a return may not make a difference because their offer amount is their offer amount no matter how much they owe. And in some cases, reducing the liability by filing an original return could even make them a less likely offer in compromise candidate.

- If the debt for an SFR year is nearing its expiration under the IRS’s 10-year collection statute, it may not be worthwhile to file an original return to replace SFR.

So while my general recommendation is to file an original return for an SFR because in the majority of cases it reduces the liability, that is not necessarily always the case, and in fact sometimes if you’re going for an offer in compromise you may, counterintuitively, prefer the liability amount to be higher.

So there is no one-size-fits-all answer regarding whether to file an actual tax return to replace an SFR for a specific year, and the decision depends on a thorough analysis of the ramifications of filing an original return for each year.

2. How to file an original return

So once you’ve determined that it’s in your best interest to file an original return to replace an SFR, you actually have to do it.

I’ve gone over this process in more detail in my article on how to file back taxes, but here’s the summary version:

Step 1: Pull your IRS transcripts.

The first step is to get your IRS transcripts — which you can do online at https://irs.gov/individuals/get-transcript — for the year.

I’d recommend pulling your wage and income transcript, which will show you all the 1099s, W-2s, K-1s, 1099-Bs, etc., that the IRS has received for you for a given year, so you can check to make sure you have the information that you need to file your returns.

I’d also recommend pulling your account transcript so you can see any payments or other credits made on your account during the year.

Step 2: Gather your other records.

As informative as they are, your IRS transcripts likely won’t have all the information you need to file your return. For example, your transcripts won’t show you (and this list is far from exhaustive):

- Charitable contributions

- Business expenses

- Medical expenses

- Property tax payments

- Childcare expenses

So go back through your old records for the year you’re filing and pull any and all pertinent tax records!

Step 3: File the return.

Now that you have your transcripts and records in hand, prepare your returns! You can electronically file the last three years, but if the return you’re filing is older than that, you’ll need to paper file it at the appropriate address found here.

How to Know When the IRS Has Filed an SFR For You

Here is how you can find out if the IRS has filed an SFR for you for a given tax year.

Method #1: Check online.

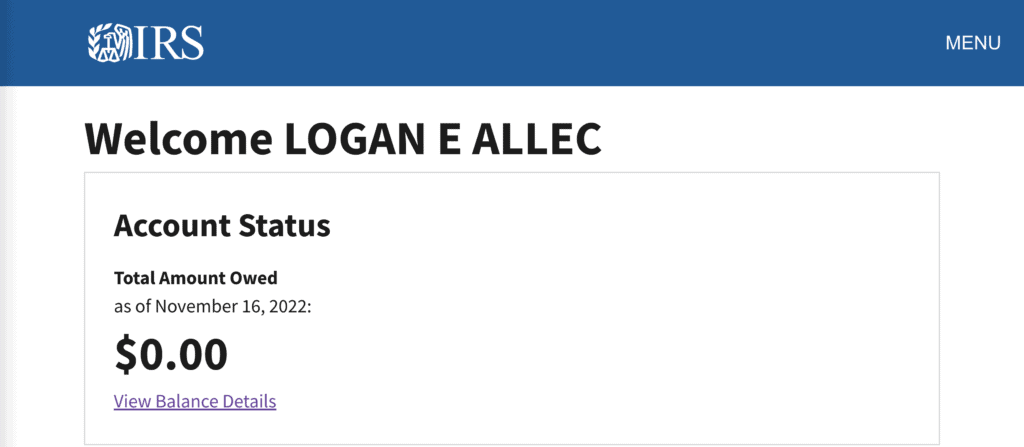

If you’ve set up a free IRS online account — which you can do at irs.gov/payments/your-online-account — you can log in to your account, and the first thing you’ll see when you log in is big letters that say “Welcome” and then your name and below that a box indicating your account balance with the IRS.

Here’s an example from my own personal IRS account:

So if you see zero there under “Total Amount Owed,” that’s a pretty good indication that the IRS has not filed SFRs for you because if the IRS had filed SFRs for you, they would likely show balances due on the SFRs, which would be reflected here.

But if you do see an amount there greater than zero, that means the IRS believes that you owe them money.

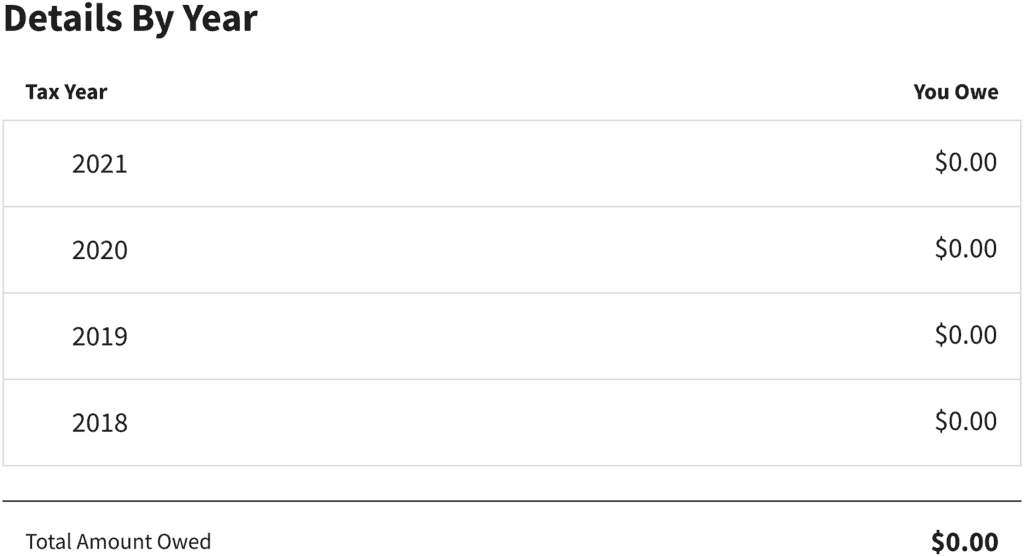

Of course, this balance could be from years for which you did file a return, but if you click “View Balance Details,” you can see your balance by year.

And if you have a balance for a year you didn’t file a tax return for, then that means the IRS filed an SFR for that year and assessed the tax accordingly.

Method #2: Check your account transcripts.

Your IRS tax account transcript is a record of — as it sounds — all of the activity on your IRS account for that year. So that includes tax assessments, penalty assessments, interest assessments, notices going out — it’s all there on the account transcript.

You can obtain online in your IRS account the current account transcript as well as the account transcripts for all tax years — up to 10 years ago so the nine previous tax periods — that had activity within the past three years.

But for many of your tax years beyond three years ago, you may not have had activity within the past three years so what can you do to get those transcripts?

You could hire a tax professional like we have at Choice Tax Relief — we have a direct line with the IRS to pull account transcripts — or you can request them using Form 4506-T.

So when you get your account transcripts for the years for which you haven’t filed, they’ll hopefully look pretty bare — and if they look bare, that means the IRS has not filed an SFR for that year.

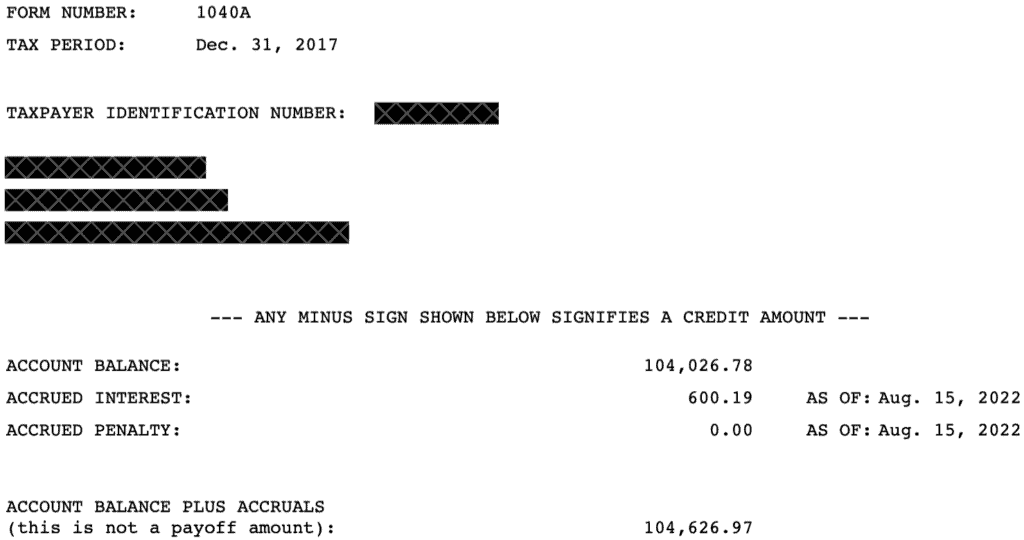

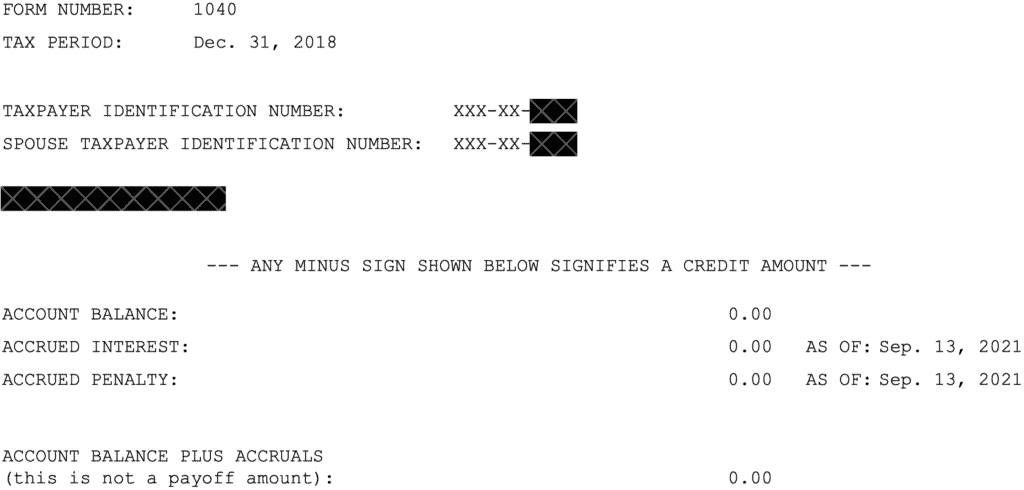

Here’s what the top of a typical account transcript for a non-filer looks like for a tax year for which the IRS has not filed an SFR:

There is no assessed balance or accrued interest and penalties because this individual did not file a tax return.

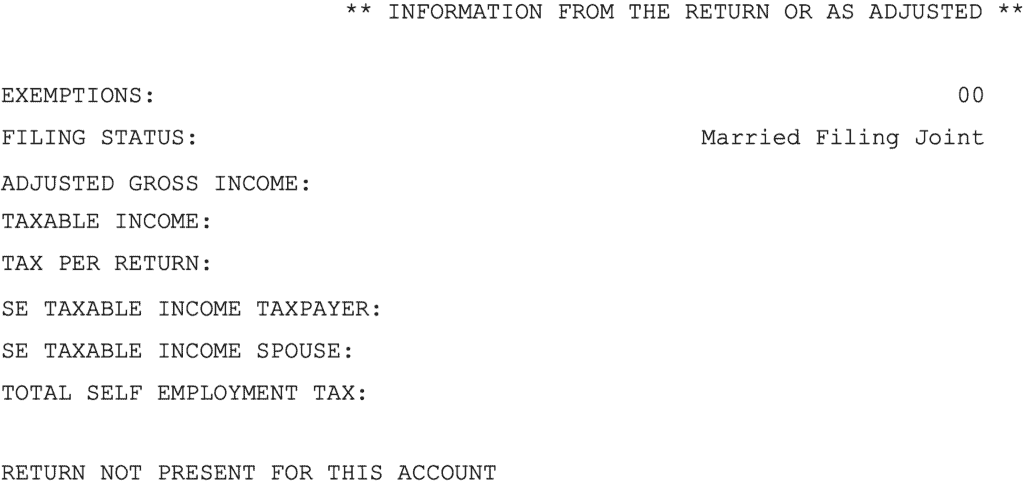

The next section of the account transcript is the section in which some basic information from your tax return or SFR would normally appear.

However, this section would likewise be empty if you haven’t filed a return for the year and the IRS has not filed an SFR for the year.

Note the phrase “return not present for this account” at the lower left of the image above.

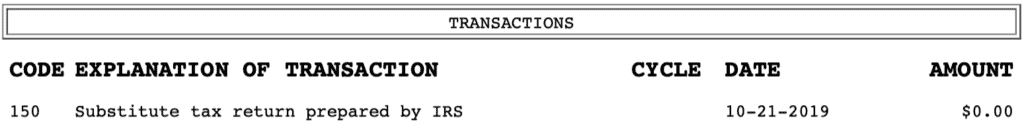

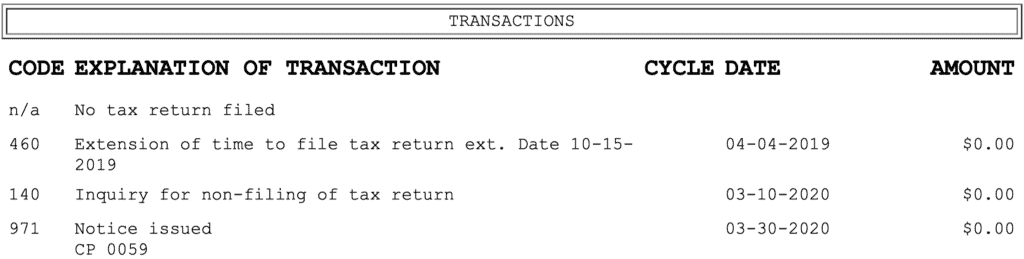

And finally, the last section of the account transcript — the “transactions” section — will likely look pretty bare as well, like this:

You’ll likely see a “No tax return filed” note at the top.

At the bottom of the image from the sample transcript above, you’ll also see Code 971 — “Notice Issued CP 0059”. This indicates that the IRS sent the individual a CP59 Notice, informing the taxpayer that they didn’t file a tax return and reminding them to do so if they are so required.

The IRS may send subsequent notices after the CP59, such as the CP515, CP516, and CP518. All of these notices use increasingly stronger language to encourage the taxpayer to file their tax return.

So that is what an account transcript would generally look like for a year in which the individual did not file a tax return for the year and the IRS did not file an SFR for the year.

But if the IRS did file an SFR for you for a year, you will see a very different-looking account transcript for the year.

You will see amounts in the top part of the transcript that shows what you the IRS believes that you owe them — and these amounts will be based on the SFR the IRS prepared for you.

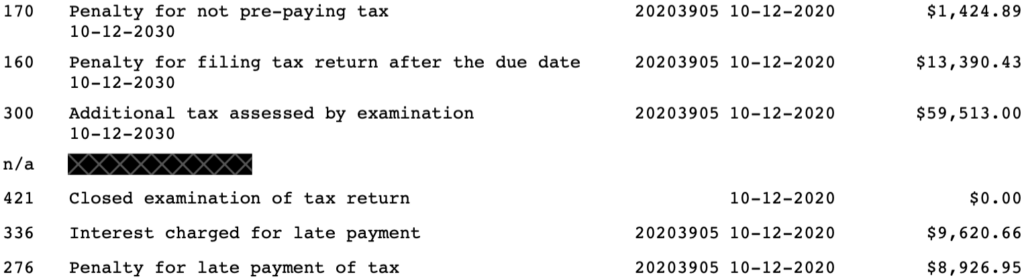

This sample taxpayer was a 1099 income earner, and he hadn’t filed tax returns in a while, and the IRS filed an SFR for him just based on his gross 1099 amount.

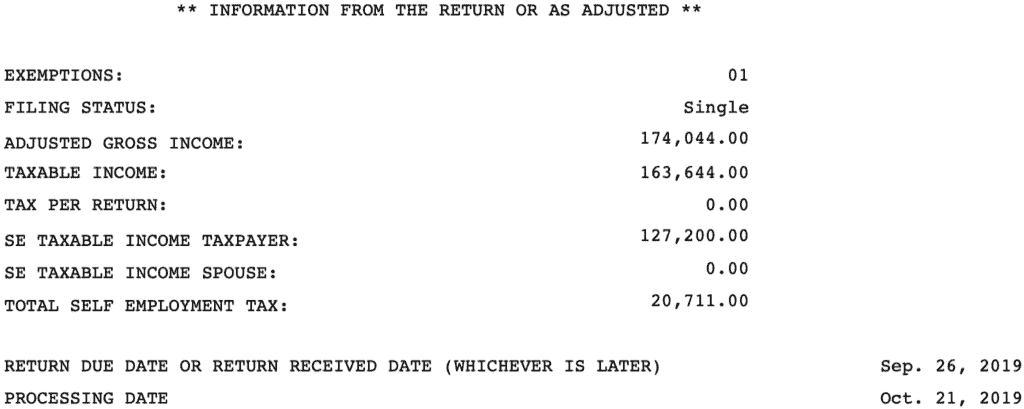

And in the “Information From the Return or As Adjusted” part of the account transcript, you’d see — for a non-filer with an SFR — key amounts from the SFR itself.

So in this case, the IRS determined this individual’s adjusted gross income — just based on his 1099 — to be $174,044. The IRS gave him just one exemption and the standard deduction, assuming his filing status is single — when he was actually married — giving him a taxable income of $163,644.

And the IRS is basing his regular income tax based on that amount and his self-employment tax basically just based on his 1099 income.

But the telltale sign on an account transcript that the IRS has filed an SFR for you is in the transactions section. If you see Code 150 down in the transactions section of your account transcript, that means the IRS prepared a substitute for return for you.

And then a little while later you’ll see the actual assessment of taxes, penalties, and interest by exams based on that SFR.

Method #3: Call the IRS.

Of course, you could call the IRS at 1-800-829-1040 between the hours of 7:00 AM – 7:00 PM (your local time), Monday through Friday, and ask someone at the IRS if the IRS has filed any SFRs for you.

When you make this call, I would recommend you obtain the following information for each year:

- Whether an SFR was filed and if so when

- Current account balance

- The debt’s collection statute expiration date (CSED) — this is the date the tax debt will “drop off”

IRS SFR Frequently Asked Questions

Here are some common questions people have about IRS SFRs.

1. How long before I get an SFR from the IRS?

The IRS sends a series of notices first, but you can expect the IRS to file an SFR for you within five years of your return’s due date.

2. How far back can the IRS go to file an SFR for me?

The IRS can theoretically go back an unlimited amount of time for unfiled returns, but they typically don’t go back beyond five years.

3. Must the IRS process an original return after they prepare an SFR?

Yes, the IRS must process an original return after they prepare an SFR.

4. What is the IRS date of assessment for SFRs?

The date the IRS assesses a tax based on an SFR is typically 12-24 months after the SFR is actually prepared.

5. Where should I mail original returns after the IRS files an SFR?

Mail it to the date in the notice.

6. Did the IRS suspend the ASFR Program?

Yes, the IRS suspended the ASFR Program for a few years.