7 Offer in Compromise Tips to Settle Your Back Taxes

An offer in compromise could be the solution to your tax debt problems, but you have to be smart about it.

See, the IRS actually rejects the majority of offers in compromise it receives.

So you have to do everything right to have the best shot at the IRS accepting your offer in compromise.

Here are my top seven IRS offer in compromise tips.

Table of Contents

1. Make Sure You Qualify

Not everybody qualifies for an offer in compromise.

So before you submit your offer, make sure you do, or you will be wasting a lot of time and potentially money as well.

As a baseline, before the IRS will even look at your offer in compromise, these three things must be true:

- You have to be in compliance with the last six years’ of tax return filings.

- You must be in compliance with your current-year tax withholdings or estimates.

- You can’t currently be in bankruptcy.

Those are just the baseline requirements for the IRS to even review your offer; once the IRS reviews your offer, it has to qualify based on its merits.

If you’re going for the most common offer in compromise — the doubt as to collectibility offer in compromise, in which you’re arguing to the IRS that you can’t afford to pay what you owe — you have to make sure that your reasonable collection potential as calculated on Form 433-A (OIC) is less than your tax debt. You can learn more about this calculation in my article on the offer in compromise formula.

2. Don’t Try to Save Up Money

One big mistake I see people who come to us at Choice Tax Relief do is save up a bunch of money “to put toward their offer in compromise.”

This is actually a big mistake for a few reasons:

- Pretty much your entire cash balance — less the sum of $1,000 and one month of your basic living expenses as determined by IRS rules — has to be given to the IRS in an offer in compromise.

- The ability to save up money every month is generally an indicator to the IRS that you have at least some free cash flow every month after all your basic expenses are paid. And the more free cash flow you have every month, the more likely it is the IRS will reject your offer in compromise and simply direct you to pay them that extra cashflow every month in an installment agreement.

- You can’t undo saving all this cash. If you try to get rid of it by sending it to a family member or close friend or something like that, the IRS considers that to be a dissipation of assets, and they will require that that dissipated amount to be included in your offer in compromise amount, even if you are no longer in direct possession of the cash. Note that there are some cash management strategies you can employ if do find yourself with “too much cash” before you submit your offer to the IRS.

The bottom line is that the best time to submit an offer in compromise to the government is when you are in bad financial shape, and stashing away a lump of cash month after month — even if you have the best of intentions — is not advisable.

3. Get a Job

Now, this offer in compromise tip may some counterintuitive given that I just told you that the best time to submit your offer in compromise is when you are in bad financial shape.

And we get a lot of people who come to us because they just lost their job and so they think that now is the perfect time to submit an offer in compromise because they aren’t making any money right now except maybe some unemployment checks.

And while that’s quite intuitive and makes a lot of sense on the surface, the IRS doesn’t view it that way, especially the younger and healthier you are.

Why?

Because the IRS knows that people generally don’t stay unemployed forever. So it’s highly unlikely that if you recently became unemployed that the IRS will just allow you to put “zero income” on your 433-A (OIC). If you do that, the IRS will probably want you to do some kind of income averaging calculation or it may even completely ignore this period of unemployment and based your monthly income on what you used to make.

Don’t believe me? It says it right in the table in Section 5.8.5.20(4) of the Internal Revenue Manual, which says:

“If a taxpayer is temporarily or recently unemployed or underemployed, use the level of income expected if the taxpayer were fully employed and if the potential for employment is apparent.”

Now, there are exceptions. There are special circumstances. And obviously the older you are, the reality is the less likely it is for you to return to full employment after becoming unemployed, so your age is actually a big factor here.

But if you’re young and healthy, I would actually recommend getting a job — it’s OK to make a lifestyle choice to make less than you were before; that’s OK — before submitting an offer in compromise so that you can show to the IRS, “This is what I make,” and they won’t try to do some weird income averaging on you or something like that.

4. Keep Your Financial Situation Stable

When you submit an offer in compromise, you have to submit along with it Form 433-A (OIC), which is a fairly comprehensive disclosure of your financial situation.

But here’s the deal.

The IRS can take over a year to actually review your offer in compromise, and in its review it may ask you for updated financial information.

And if your financial situation has changed significantly for the better since you submitted your offer, you may no longer qualify for an offer in compromise, or you may have to increase your offer amount.

Essentially, you should try to keep your financial situation as consistent as possible from the time you submit your offer in compromise to the time the IRS makes a decision on it.

Note that part of keeping your financial situation stable is not opening up new businesses before you submit your offer or while it’s pending.

This is because if the offer examiner finds that you own a business — and yes, they can generally find this out through your state’s Secretary of State office — they will send your offer to the IRS’s business offer in compromise department for review.

The primary thing they are concerned about if you own a business is dissipation of assets, that is, you putting cash and other assets into your business in an attempt to not include them in your personal offer in compromise amount.

5. Set Up a Payment Plan With Your State

Many people who owe the IRS also owe taxes to their state.

And if you didn’t know, state revenue departments are generally much less agreeable to an offer in compromise than the IRS is.

More often than not, the best resolution you’ll get for your state tax debt is a payment plan — otherwise known as an installment agreement.

But that’s not all bad news because your monthly payment toward your state tax debt just might lower your disposable monthly income in your offer in compromise calculations.

So if you owe state tax debt, consider making payment arrangements with your state revenue department before submitting your IRS offer in compromise.

6. Know the IRS Standards

If you just run through the Form 433-A (OIC) like you would, say, a loan or other financial product application, you’re going to get it wrong.

You have to input the figures according to the IRS’s math as found in Section 5 of Chapter 8 of Part 5 of the Internal Revenue Manual.

For example, you can’t necessarily just put your total housing expenses on Line 40 of Section 7; you have to look at the IRS’ Local Housing Standards for your county and your family size and not put more than that amount on the form. There could be exceptions, and I’ve covered some of those in my article on the IRS offer in compromise formula, but in general, you’re limited to the IRS standard expenses for several line items and overall have to complete the Form 433-A (OIC) in accordance with the financial analysis section of the Internal Revenue Manual

7. Don’t Be Afraid to Appeal a Rejection

Finally, if your offer in compromise is rejected, appeal it! You have nothing to lose.

You would file your appeal using IRS Form 13711, Request for Appeal of Offer in Compromise.

And because we at Choice Tax Relief are so aggressive with our offers that we submit for our clients, very often our offers in compromise are rejected by the offer examiner reviewing the offer but then we win in Appeals.

In Appeals, you have a completely separate — and oftentimes more knowledgeable — IRS employee reviewing your offer.

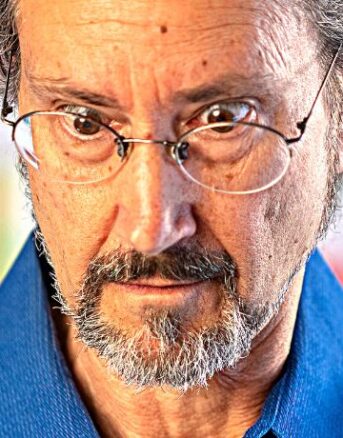

And we also know our way around IRS Appeals thanks to Peter Salinger on our team — a man who spent over 30 years at the IRS, first as a revenue officer and then as an Appeals settlement officer.