IRS Letter 1862: How to Respond to an IRS Letter 1862

IRS Letter 1862 is a letter issued by an IRS tax examiner to a taxpayer after the examiner has prepared a substitute for return (SFR) for that taxpayer to calculate their balance due for the year based on information submitted to the IRS by others on documents such as Form W-2, Form 1099, Schedule K-1, etc.

This letter serves as the tax examiner’s initial contact with the taxpayer as well as a 30-day letter, giving the taxpayer 30 days to respond to the information shared in the letter.

The Letter 1862 typically begins with language like, “We have no record of receiving your Form 1040, U.S. Individual Income Tax Return, for the tax periods shown above.”

Table of Contents

Other Documents Included With IRS Letter 1862

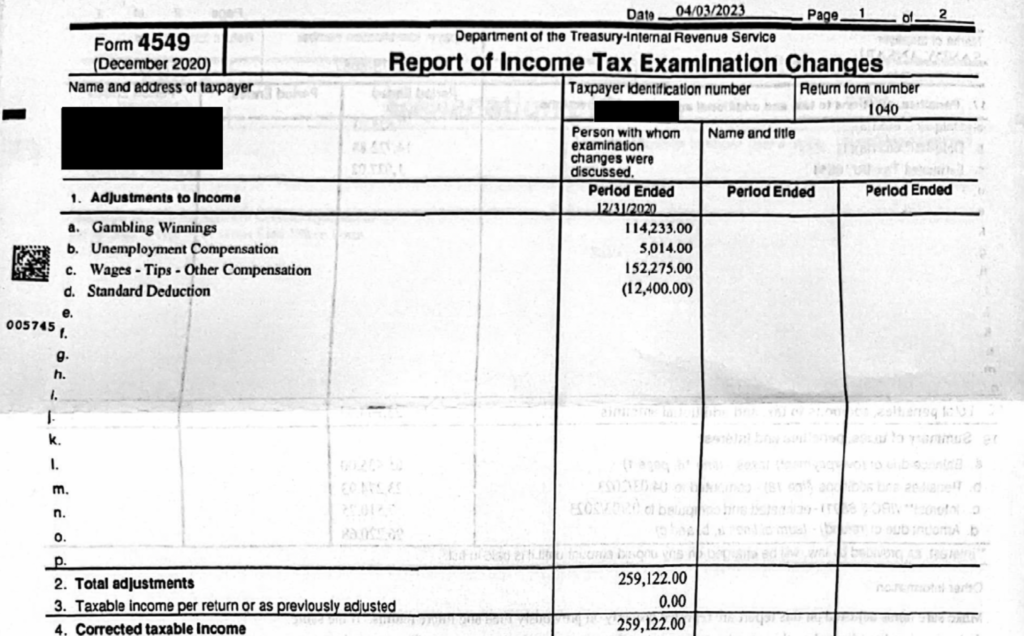

Along with the Letter 1862, the tax examiner will include Form 4549 (Report of Income Tax Examination Changes) to explain to the taxpayer how they calculated the taxpayer’s balance due for the year before penalties and interest.

The Letter 1862 may also include a delinquency penalty explanation page, explaining how it has calculated any failure-to-file and failure-to-pay penalties it intends to assess against the taxpayer.

Why Did I Receive IRS Letter 1862?

You received IRS Letter 1862 because you did not file a tax return for a particular tax year, and because the IRS believes that you have a filing requirement for that year, it prepared a substitute tax return for you known as an SFR.

What If You Don’t Respond to IRS Letter 1862?

If not responded to within 30 days, the tax examiner will typically send IRS Letter 3219, which is the standard 90-day letter of Statutory Notice of Deficiency for proposed SFR assessments for SFRs not generated by the ASFR Program.

Note that if your SFR was prepare by the IRS Automated Substitute for Return (ASFR) Program rather than manually by a tax examiner, the equivalent 30-day letter is the Letter 2566.

When Does the IRS Send Letter 1862?

The IRS generally doesn’t prepare an SFR and send Letter 1862 for at least a couple years after the should-have-been-filed tax returns’ due date.

For example, in a recent client case where the client received IRS Letter 1862 for their 2020 tax return — which was due in 2021 — the IRS sent the Letter 1862 in April 2023 (about two years after the return was originally due).

You can learn more about this client’s case and how we approach it later in this article.

IRS Letter 1862 At a Glance

| Letter Type: | Initial Contact and 30-Day Letter |

| Generated By: | IRS Tax Examiner |

| Preceded By: | N/A |

| Followed By: | Letter 3219 |

| Recommended Action: | File Original Return to Replace SFR |

How We’ve Helped Our Clients With IRS Letter 1862

Our Client’s Problem

Behind the Letter 1862 the IRS tax examiner sent our client, they also included Form 4549 showing their SFR calculations.

As you can see on the Form 4549 behind the Letter 1862, the client had the following items of income:

- Gambling Winnings: $114,233

- Unemployment Compensation: $5,014

- Wages, Tips and Other Compensation: $152,275

In addition to this income, the IRS gave the taxpayer the standard deduction.

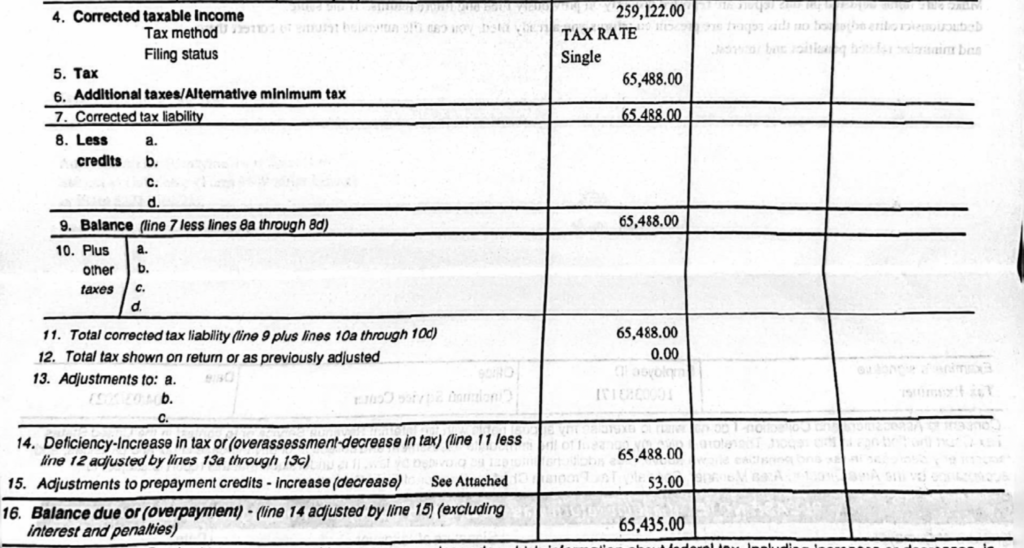

Based on this information, the IRS calculated a tax due for the year of $65,435.

What We Did to Help Our Client

The first thing we did was prepare original returns to replace the SFR the client. This result in immediate savings since:

- The client had gambling losses in excess of their gambling winnings, which we were able to take as an itemized deduction of $114,233 (rather than the measly standard deduction).

- We filed as married filing jointly, which created tax savings.

This significantly reduced the client’s balance.

However, they still could not pay the balance in full, so rather than allowing the IRS to subject them to wage garnishments and bank levies, we negotiated a workable installment agreement on behalf of the client over several years.