IRS Letter 2566: What To Do If the IRS Calculated Your Taxes For You

IRS Letter 2566 is a 30-day letter issued by the IRS Automated Substitute for Return (ASFR) Program to a taxpayer after it has prepared a substitute for return (SFR) for that taxpayer.

This letter proposes an assessment of taxes, penalties, and interest based on the SFR prepared by the IRS ASFR Program.

If not responded to within 30 days, the ASFR Program will typically send IRS Letter 3219N, which is the 90-day letter (Statutory Notice of Deficiency) for proposed SFR assessments generated by the ASFR Program.

Note that if your SFR was manually prepared by a tax examiner rather than by the ASFR Program, the equivalent 30-day letter is the Letter 1862.

What Is Assessment?

The assessment of a tax is the formal recording of a taxpayer’s tax debt — including penalties and interest — in the government’s books, that is, its financial records.

Why does this matter to you? The main reason is because according to Internal Revenue Code § 6502 “Collection After Assessment”, the IRS must assess a tax before attempting to collect it from you — such as through wage garnishments or bank levies.

That is why the IRS actually assessing a tax is such a big deal because once a tax is assessed against you, the IRS has pretty awesome authority to collect it from you.

But assessment — the actual recording of your debt in the government’s books — must happen first.

Table of Contents

IRS Letter 2566 At a Glance

| Letter Type: | 30-Day Letter |

| Generated By: | IRS ASFR Program |

| Preceded By: | N/A |

| Followed By: | Letter 3219N |

| Recommended Action: | File Original Return to Replace SFR |

IRS Letter 2566 Explained, Part by Part

Here is a full explanation of the Letter 2566, part by part.

Part 1: Heading

At the very top of the first page of Letter 2566, you’ll see several important items in the top right:

- Letter Date: This is the date the Letter 2566 was generated by the IRS ASFR Program.

- Social Security Number: Your Social Security Number should appear here; if it doesn’t, or if it’s incorrect, contact the contact person (see further down in the heading) ASAP.

- Tax Year: This is the tax year for which the IRS ASFR Program prepared an SFR for you.

- Tax Form: This is the tax form for the tax year above for which the IRS ASFR Program prepared an SFR for you; it very likely says Form 1040 here.

- Filing Status: This is the filing status the IRS ASFR Program used when preparing your SFR; it is likely single (if you are unmarried) or married filing separately (if you are married).

- Contact Person: This is the name of your contact person at the IRS ASFR Program.

- Contact Telephone Number: This is your contact person’s telephone number.

- Contact Hours: These are the hours during when you contact person will be available at the telephone number indicated above.

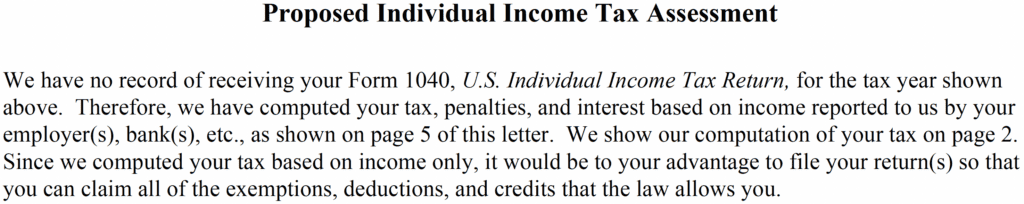

Part 2: Why You Are Receiving This Letter and What the IRS Did About It

Then, at the beginning of the actual letter, the IRS informs you:

- Why you are receiving this letter — because the IRS has no record of you filing a tax return for the year in question

- What the IRS did about it — it computed your taxes, penalties, and interest for you based on third-party data reported to it on tax documents such as W-2s, 1099s, K-1s, etc.

- What the IRS recommends you do — it recommends that you file your own return since in computing

Part 3: What You Must Send the IRS Within 30 Days

Next, the IRS tells you what you must send it within the next 30 days:

- Your original return for the year in question to replace the SFR.

- Your signed “Consent to Assessment and Collection” form agreeing to the IRS’ proposed assessment based on the SFR.

- A statement explaining why you do not have a filing requirement for the year in question or other information you’d like the IRS to take into account.

- Your appeal to the IRS’ assessment based on the SFR.

If you do not take one of these stems within 30 days of the date of your Letter 2566, the IRS will issue you a Statutory Notice of Deficiency in the form of Letter 3219N.

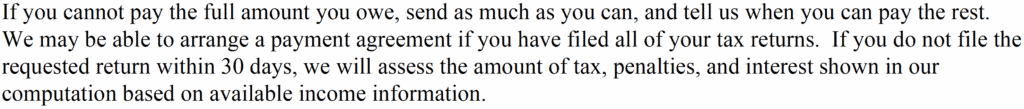

Part 4: Information on Installment Agreements and What Happens After 30 Days

Next, the IRS gives you some information about what you can do if you cannot pay the full amount, which is to pay the IRS as much as you can and possibly set up an installment agreement.

Note: The IRS isn’t being completely forthright here; even if the IRS’ proposed assessment based on the SFR is correct — which it likely isn’t because, for example, SFRs don’t give you all the deductions you’re entitled to — setting up an installment agreement to pay the assessment in full may not necessarily be the best option for you. Check out our article about tax relief to learn about other options available to you.

The IRS then informs you that if you do not respond to this letter within 30 days, the IRS will officially assess the proposed assessment (though they will send you Letter 3219N first before doing so, which gives you an additional 90 days before assessment takes place).

Part 5: Information on Where to Get Tax Forms

At the end of the letter, the IRS tells you where you can get the tax forms you need to file your original tax return to replace the SFR.

Of course, you can use tax software to file your original return or hire professionals like us at Choice Tax Relief to file your returns as well.

When the IRS Sends Letter 2566

The most common reason for the IRS sending you a Letter 2566 is when the following things happened:

- You did not file your tax return for the tax year mentioned on the letter and therefore the IRS

- The IRS Automated Substitute for Return (ASFR) Program prepared a substitute for return (SFR) for this year for you. You can learn more about the SFR program in this article.

What You Should Do If You Receive a Letter 2566

In most cases, the best thing to do when receiving a Letter 2566 from the IRS is to simply file your original tax return to replace the IRS ASFR Program’s SFR.

Now, if the year in question is from a while back, that may be easier said than done.

However, lucky for you, I have put together a guide to filing back tax returns that you can access by clicking here or by watching the video below!

Of course, if you still owe the IRS a balance due after filing your original return, you’ll need to figure out how you’re going to resolve this balance.

Now, you could simply pay whatever balance is owed in full along with penalties and interest.

But it’s generally at least worth seeing if you’ll qualify for any penalty abatement and if you really can’t pay what you owe at the moment see if you could qualify for some kind of tax relief option, such as an offer in compromise, some kind of installment agreement, being placed in currently not collectible status, or several others.

To learn more about these options, read this article about how to get IRS tax debt relief or watch the video below.