THERE IS NO IRS FRESH START PROGRAM 2023

A healthy minority of people who reach out to us at Choice Tax Relief bring up the IRS Fresh Start Program.

They often lead with, “Hey, can you guys get me into the Fresh Start Program?”

And that question doesn’t really make sense, and by the time you finish this article I hope you’ll understand why. But I can understand where that question is coming from.

Do you have tax debt? Don’t fall for the “Fresh Start Program” ads.

Book your FREE consultation with Choice Tax Relief by clicking here.

Table of Contents

Don’t Fall For the “Fresh Start Program” Ads

So the reason why people call us at Choice Tax Relief asking about the Fresh Start Program is because they saw or heard an ad like this one that I spotted on Twitter recently:

False; the IRS has made no such announcement of a “2023 Fresh Start Program.” pic.twitter.com/91LtD9je3l

— Logan Allec, CPA (@loganallec) August 23, 2023

In my opinion, these ads are fraudulent; the IRS has made no such announcement of a “2023 Fresh Start Program.”

They simply exist to create a false sense of urgency so that people can call the shady tax relief company and hand over their hard-earned cash.

What Else Will They LIE to You About?

If you have tax debt, I challenge you to think critically on this point if you are looking to hire a professional services firm to deal with your tax debt.

If a company is willing to be misleading in its marketing…

- …isn’t it very likely that they will be misleading in their sales process? All you are to the salesman on the other end of the phone is a nice fat commission check just waiting to be pitched.

- …isn’t it very likely that they will cut corners in the back office when it actually comes to negotiating with the IRS on your behalf?

I’m not accusing any particular firm of anything, but I just want you be aware.

Do you have tax debt? Don’t fall for the “Fresh Start Program” ads.

Book your FREE consultation with Choice Tax Relief by clicking here.

The Truth About the IRS Fresh Start Program

In reality, the IRS Fresh Start Program isn’t something that can go away; it’s not a “program” you can get into.

It Was a Set of Changes the IRS Made Over a Decade Ago

The IRS Fresh Start Program was simply a set of changes to things like notice of federal tax lien filing thresholds and offer in compromise submission procedures that the IRS announced in three news releases in 2011 and 2012.

And as I will show you later in this article, the IRS used the phrase “fresh start” in these news releases.

They said things like, “The IRS is making changes to such-and-such policy in order to help struggling taxpayers make a fresh start.”

That’s it; that’s all the IRS Fresh Start Program is (or was, really).

It’s not some special program that wipes away everybody’s tax debt.

It’s simply the phrase the IRS used to describe eight taxpayer-friendly changes it made over 10 years ago to several of its policies, procedures, and programs having to do with tax relief and collections.

I Admit, the Phrase Is Catchy

But of course, that phrase the IRS used in these news releases — “fresh start” — was quite catchy.

And so around that time we saw a lot of marketing departments at tax relief companies start using this IRS “fresh start” language in their marketing and advertisements to — in my professional opinion — make the Fresh Start Program sound like something more than it was in order to convince people to sign up with them.

These companies made it sound like, “Sign up with us, and all your tax debt will be wiped away in the baptismal waters of the IRS Fresh Start Program.”

An Example of What the Fresh Start Program Did Do

When in reality, the IRS Fresh Start Program simply made a few changes to some things — and I’m going to go over what they are in this article — but just for sake of example, it raised the threshold of debt for when the IRS will file a tax lien from $5,000 in unpaid taxes, penalties, and interest to $10,000.

And, yes, it also did make it a bit easier for some folks to qualify for an offer in compromise.

But it’s not this sweeping tax debt forgiveness program that some have made it out to be.

So in this article I’m going to set the record straight about the IRS Fresh Start Initiative and tell you exactly what it did for taxpayers who owe the IRS.

Did the Fresh Start Program Make Changes to the Offer in Compromise Program?

Yes, the Fresh Start Program did make more people eligible for an offer in compromise, which is an agreement with the IRS to settle your taxes for less than you owe.

How?

Well, before the Fresh Start Program, when determining how much you should offer in compromise to the IRS, you had to multiply your monthly disposable income (calculated according to the IRS’ financial analysis rules) by 48 months if you were doing a lump sum offer in compromise or by 60 months if you were doing a periodic payment offer in compromise

However, in May 2012, as part of the Fresh Start Program, the IRS announced that they would be shortening those multipliers to 12 months and 24 months, respectively, thereby reducing the amount that a given taxpayer would have to offer in compromise of their tax debt and making more people qualify for an offer in compromise.

With respect to the IRS offer in compromise program, the Fresh Start Program also:

- Made the definition of a dissipated asset for offer in compromise purposes more taxpayer favorable

- Made income-producing assets generally not included in the reasonable collection potential calculation for ongoing businesses

- Expanded the miscellaneous allowance amount in the National Standard amount

- Clarified that federal student loan payments would be allowed to reduce a taxpayer’s disposable income for offer in compromise calculation purposes

- Made payments for delinquent state and local taxes to be allowed based on kind of a pro-rated basis compared to the amount due the IRS

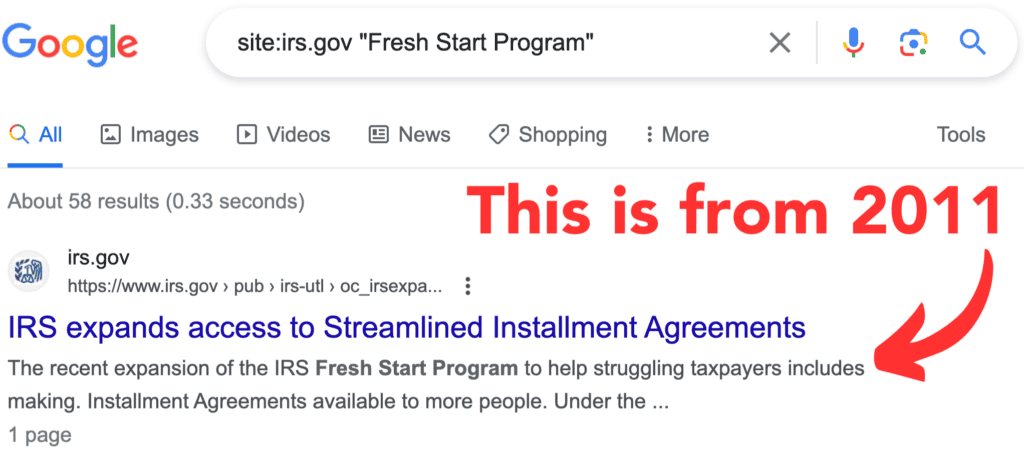

There Is No IRS Fresh Start Program 2023!

The IRS has made no such announcement about a “2023 Fresh Start Program”; there is simply no IRS Fresh Start Program for 2023.

If you don’t believe me, do a Google search of irs.gov for the term “Fresh Start Program” (in quotes).

When you do so, you will see results from years ago.

This is because the IRS Fresh Start Program, as I explain below, is nothing more than a series of changes the IRS made in 2011 and 2012 to its practices, policies, and programs when it comes to tax collections and relief.

And you should be very wary of any company who’s misleading you in this way.

So what, then, is the IRS Fresh Start Program and what did it do?

What Is the IRS Fresh Start Program?

The IRS Fresh Start Program is a series of changes the IRS made in 2011 and 2012 to its practices, policies, and programs when it comes to tax collections and relief.

Here are the changes the IRS Fresh Start Program made.

1. Increased Notice of Federal Tax Lien Filing Threshold From $5,000 to $10,000

On February 24, 2011, the IRS issued a news release — News Release 2011-20 — that was titled, “IRS Announces New Effort to Help Struggling Taxpayers Get a Fresh Start; Major Changes Made to Lien Process”.

So from the get-go, the initial focus of the Fresh Start Program was really not so much making it easier for folks to get forgiveness but simply making it so more people avoided getting a notice of federal tax lien filed against them in state or county records.

And basically what a tax lien notice is is a notice to the general public filed in state and/or county records that such-and-such person — in this case fashion personality Vanessa Williams — owes the United States government a certain amount of money — in this case by way of example $369,249.89.

So, for example, let’s say a taxpayer wants to refinance their home with a new lender. But there’s a notice of federal tax lien filed against them.

This would make it very unlikely unless the lien is subordinated or otherwise addressed, which is something we do for clients, that a lender would want to do the refi because if the borrower defaults, the IRS’s position would take priority over theirs and there may not be enough left over on the sale of the house to make the lender whole.

Lenders and other kinds of creditors generally do not want to be in competition with the United States when it comes to your property.

So previously, before the Fresh Start Initiative, the IRS would file a notice of lien on folks who owed them at least $5,000 in combined taxes, penalties, and interest, but the Fresh Start Initiative increased that threshold amount to $10,000, where it is today.

2. Eased Requirements to Obtain a Lien Withdrawal For a Released Lien

Tax liens no longer appear on your credit report; the three credit bureaus changed their policy on this back in April 2018.

But before this, notices of federal tax liens would show up on credit reports, which could obviously adversely affect the individual’s ability to obtain credit.

This had other consequences as well. For example, many state licensing boards will not grant a license to somebody if they have a notice of federal tax lien filed against them.

So let’s say that the individual paid off the debt to the IRS indicated on the notice of federal tax lien.

Before the Fresh Start program, what would happen? The IRS would release the lien no later than 30 days after the taxpayer paid their liability. And this means that the lien no longer has any effect because the debt has been paid.

But before April 2018, released tax liens still appeared on individuals’ credit reports.

The way to get them off one’s credit report was to have the notice of federal tax lien withdrawn, which would completely eliminate the lien from the individual’s credit report as though it had never been filed in the first place.

And prior to the Fresh Start Program, the IRS would not necessarily withdraw a lien simply because it had been released.

But the Fresh Start Program changed that by making it so that a taxpayer who satisfied the following three conditions could get their lien withdrawn:

- The tax liability stated on the lien has been satisfied.

- The taxpayer is in filing compliance for at least the past three tax years, including all individual returns, business returns, and information returns.

- The taxpayer is current on their estimated tax payments and federal tax deposits.

So thanks to the Fresh Start Program, if a taxpayer meets these criteria, they can prepare Form 12277, complete the informational questions in Sections 1-9, check the “Released” box in Section 10, check the fourth box in Section 11, explain their situation in Section 12, and they would sign the form and mail it to the IRS, and the IRS will withdraw their lien.

3. Eased Requirements to Obtain a Lien Withdrawal With a Direct Debit Installment Agreement

The Fresh Start Program also made it so that compliant taxpayers who owe $25,000 or less and who have never defaulted on an installment agreement with the IRS previously can enter into a full-pay Direct Debit Installment Agreement with the IRS and have their notice of federal tax lien withdrawn once they make three consecutive direct debit payments under that installment agreement.

They would use that same Form 12277 except this time they would indicate in Section 10 that the lien is still “Open” and in Section 11 they would check the two installment agreement boxes in Section 11.

This option is not available for taxpayers who owe the IRS more than $25,000.

4. Expanded Eligibility for Streamlined Small Business Installment Agreements

Prior to the Fresh Start Program, small businesses who owed less than $10,000 to the IRS were eligible to participate in a streamlined Direct Debit installment agreement program with the IRS; the Fresh Start Program increased that amount to $25,000.

5. Expanded Eligibility for Streamlined Offers in Compromise

An offer in compromise is an agreement between the IRS and a taxpayer to settle the taxpayer’s tax debt for less than they owe.

And as I discussed in my piece on offer in compromise basics, there is a streamlined offer in compromise program that the IRS has for certain taxpayers.

Just for clarification, this streamlined program does not make it easier to get approved for an offer in compromise; it simply makes the process easier.

For example, with a streamlined offer in compromise, IRS employees will typically simply take additional information they need over the phone rather than through paper mail as is typical with a non-streamlined offer in compromise.

And prior to the Fresh Start Program, taxpayers had to have a tax liability of $25,000 or less to participate in the streamlined offer in compromise program; the Fresh Start Program increased that amount to $50,000.

The Fresh Start Program also allowed taxpayers with annual incomes up to $100,000 to participate in the streamlined offer in compromise program, though this was temporary; currently, if you owe the IRS more than $50,000, you will not qualify for a streamlined installment agreement.

6. Extension of Time to Pay 2011 Taxes

On March 7, 2012, the IRS issued its second Fresh Start news release — News Release 2012-31 — that opened with,

“The Internal Revenue Service today announced a major expansion of its ‘Fresh Start’ initiative to help struggling taxpayers by taking steps to provide new penalty relief to the unemployed and making Installment Agreements available to more people.”

So what did this second round of Fresh Start do for taxpayers?

Well, the first thing this second round did was institute a temporary penalty relief on the failure-to-pay penalty but only for tax year 2011.

So in a typical tax year, you can file for a six-month extension of time to file your tax return if you can’t or don’t want to file it before the original deadline, which for most individual filers is April 15 or if April 15 is on an applicable holiday or weekend, the next business day after April 15.

So if you don’t want to or can’t finish your tax return by April 15, you can get an extension on filing your tax return for free until October 15 by filing Form 4868, and of course you can also file an extension for free online.

(Every year on my YouTube channel, I make a video showing people how to file an extension.)

However, this extension is only an extension on the time you have to file your tax return and not be assessed the failure-to-file penalty, which accrues at 5% per month up to five months.

This extension does not extend the time you have to pay your taxes due; those taxes are due by April 15, the original due date of your return; if you do not pay your taxes or a portion of your taxes by April 15, a failure-to-pay penalty will accrue at rate of 0.5% per month up to 25%.

But back in 2011, with the economy still recovering from the Great Recession of 2007-2009, the government decided to give certain people a break and not only allow them to extend the time they have to file their tax return but also the time they have to pay their taxes.

So under this second round of Fresh Start, the IRS said, “If you were unemployed for at least 30 days between January 1, 2011, and April 17, 2012, or if you were self-employed and experienced a 25% or greater reduction in business income in 2011 due to the economy, and if you make $100,000 or less or $200,000 or less if you’re married filing jointly and you owe $50,000 or less in taxes for tax year 2011, you can file Form 1127A and get a six-month extension of time to pay your taxes as long as you pay them in full by the extended deadline of October 15, 2012.”

But that was only for tax year 2011; it does not apply today; yes, there is still a mechanism and a form — Form 1127 — to request an extension of time to pay, but it’s not as easy to get as the 2011 provisions which applied to a lot of people given what the economy was at the time.

7. Expanded Eligibility for Streamlined Installment Agreements

If you’ve read my article on installment agreements, you know that if you owe $50,000 or less to the IRS in combined taxes, penalties, and interest, you can apply online for a payment plan online for up to 72 months.

This is a streamlined installment agreement, and it’s streamlined because you can set it up online without having to submit to the IRS a Collection Information Statement, Form 433-A or Form 433-F, that basically documents all your financial information according to IRS standards.

So now you can set up a streamlined installment agreement if you owe $50,000 or less; that is thanks to this second round of the Fresh Start Program.

Previously, before Fresh Start, you could only $25,000 or less to the IRS in order to be eligible for a streamlined installment agreement, and they only went up to 60 months.

8. Taxpayer-Beneficial Changes to Offer in Compromise Calculations

And finally on May 21, 2012, came IRS News Release IR-2012-53, which announced the third and final Fresh Start initiative.

And this one was to make the offer in compromise program a lot more accessible to more people.

So if you’ve read my article on how to calculate one’s offer in compromise, you know the general formula is to calculate your reasonable collection potential, which is a combination of your equity in assets component and your income component.

And your income component is based on your net monthly excess income as determined by IRS formulas multiplied by either 12 or 24 months — 12 months if you can pay your offer amount within five months and 24 months if you can pay your offer amount within 24 months.

Well, before the Fresh Start Program, if you could pay your offer amount within five months, you multiplied your net monthly excess income by 48 months; and if you could pay your offer amount within 24 months, you multiplied your net monthly excess income by 60 months.

So due to the changes in this math, the Fresh Start Program did make more people eligible for an offer in compromise — at least the doubt as to collectibility offer in compromise, which is the most common one submitted to and accepted by the IRS — and it did reduce the offer in compromise amounts that many people had to submit and pay.