IRS Notice CP71A Explained: What It Is and What To Do

IRS Notice CP71A is the Annual Reminder of Balance Due the IRS sends to taxpayers who have balances with the IRS that are currently in currently not collectible (CNC) status.

Since the Notice CP71A is tax year-specific, you may receive multiple CP71A notices if you owe the IRS for multiple tax years.

The IRS sends this notice annually to taxpayers with a tax year that has been in CNC status (“status 53”) for at least 65 weeks.

Note that if you have some years that have been placed in CNC status, and other years that have not been placed in CNC status, you may receive the Notice CP71A for the CNC years and some other annual reminder notice — such as the Notice CP71C — for other years.

One of the reasons the IRS sends this notice is because it is legally required to under Internal Revenue Code Section 7524, which states:

“Not less often than annually, the Secretary shall send a written notice to each taxpayer who has a tax delinquent account of the amount of the tax delinquency as of the date of the notice.”

Here is a Notice CP71A that the IRS sent one of our clients.

Table of Contents

IRS Notice CP71A At a Glance

| Letter Type: | Annual Reminder |

| Generated By: | IRS Service Center |

| Recommended Action: | Remain in CNC or Submit OIC |

IRS Notice CP71A Explained, Part by Part

Here is a full explanation of the Notice CP71A, part by part.

Part 1: Billing Summary

On the first page of the CP71A Notice, the IRS gives a line-by-line summary of what they believe you owe.

This summary could include:

- The total amount of tax the IRS believes you owe, indicated as the “Amount you owed” line item

- The amount of any tax payments and credits on your account for the year — this is not included in the example image above because the taxpayer did not have any payments or credits on their account during the year

- The amount of any penalties the IRS has assessed on your account

- The amount of any interest the IRS has charged to your account

Part 2: Payment Coupon

At the bottom of the first page of the CP71A Notice, the IRS provides you with a payment coupon if you would like to pay off the tax for the year indicated on the notice in one lump sum.

Note that if you have the cash to pay off what you owe for some tax years but not others — and keep in mind that each year would be reported on a separate CP71A — it may be in your best interest to pay off some tax years before others.

Obviously, the IRS isn’t going to tell you this — they are simply going to insist that you pay off everything by their deadline.

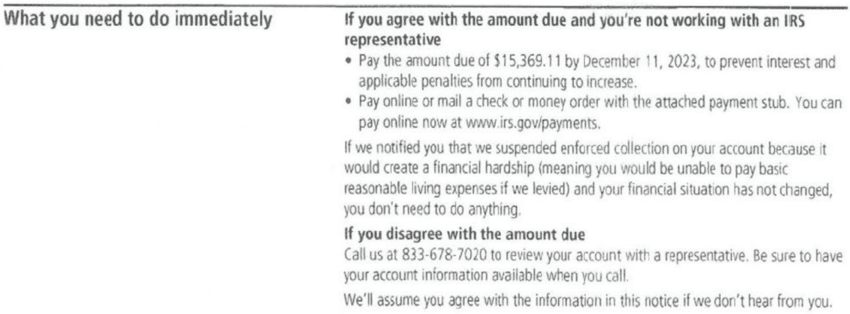

Part 3: What the IRS Wants You to Do

Obviously, the IRS is sending you this notice because they want you to take some kind of action — namely, pay the amount they believe you owe them within a certain timeframe (generally 21 days).

That said, the IRS is kind enough to inform you that if you are currently in currently not collectible (CNC) status, and your financial situation has not changed since placement into CNC status, “you don’t need to do anything.”

The IRS also provides you with a phone number to call if you disagree with the amount stated on the notice.

Part 4: Passport Denial or Revocation Information

Next, the IRS informs you that if you have “seriously delinquent tax debt,” the IRS may notify the State Department of your delinquency, in which case the State Department may revoke your passport, refuse to renew your passport, or refuse to issue you a passport.

Seriously delinquent tax debt is defined in Internal Revenue Code Section 7345 as tax debt:

- That has been assessed

- That is greater than $50,000 (note that this amount is adjusted annually — it is currently $59,000 for 2023)

- For which a Notice of Federal Tax Lien has been filed with all administrative remedies exhausted OR for which a levy has been made

- That is not in approved resolution with the government, such as an installment agreement, CNC status placement, etc.

Part 5: Payment Options

Next, the IRS informs you of its payment options that you can find at irs.gov/payments or on the IRS2Go mobile app.

It also lets you know about potential tax resolution options, such as entering into an installment agreement, submitting an offer in compromise, or requesting CNC status.

Part 6: What the IRS Will Do If You Don’t Respond

Next, the IRS lets you know that they will continue to charge penalties and interest on your account until you pay your balance and that they will continue to send you annual reminder notices of your balance until it’s paid or until the collection statute of limitations expires.

They also let you know that they may even file a Notice of Federal Tax Lien against you.

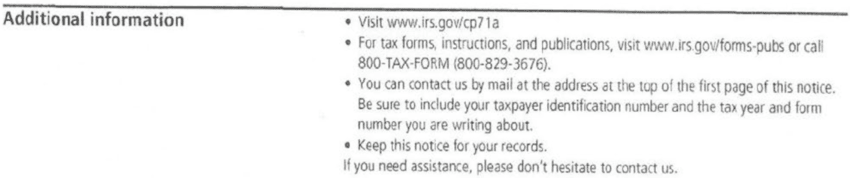

Part 7: Additional Information

Finally, at the end of the CP71A Notice, the IRS provides some additional information, such as:

- The official IRS webpage for the CP71A Notice

- Where you can obtains tax forms, instructions, and publications

- How to contact the IRS

- That you should keep your CP71A Notice for your records

What to Do If You Received Notice CP71A From the IRS

If you received a CP71A Notice from the IRS, don’t panic!

This notice is merely an annual reminder from the IRS that you still owe them back taxes for the year indicated in the notice.

The best thing you can do when receiving this notice from the IRS is to put together a game plan to determine how you’re going to tackle this tax debt.

Your options include:

- Entering into an installment agreement with the IRS to pay off your tax debt — or a portion of it — over time

- Convincing the IRS that you can’t pay them anything right now, resulting in you being placed in currently not collectible (CNC) status

- Submitting an offer in compromise to the IRS to settle your tax debt for less than you owe

If you’d like more information about any of this tax relief options, be sure to check out our article explaining what tax relief is or watch the video below to learn about the tax debt forgiveness programs.