IRS Notice CP22E: What It Is and What To Do

IRS Notice CP22E is the Notice of Examination Adjustments that the IRS sends when an IRS audit results in a balance due for a year that did not have a balance before the audit.

(If the year in question already had a balance before the audit, the IRS would typically send Notice CP21E as the Notice of Examination Adjustments.)

The IRS typically sends the CP22E Notice to a taxpayer after its Examination division has completed an audit of a given tax year that has resulted in a new balance due. In this case, the CP22E informs the taxpayer of the amount the IRS believes the taxpayer owes for the year, post-audit, along with the due date for payment.

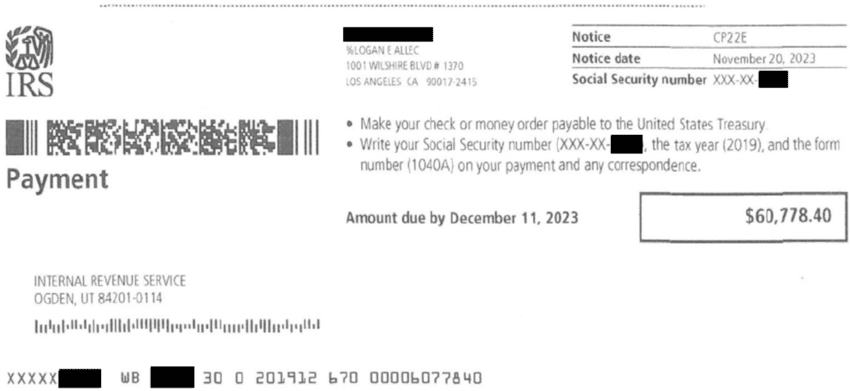

Here is a Notice CP22E that the IRS sent one of our clients after an audit of their tax return.

The IRS may also send a CP22E Notice to a taxpayer if the IRS Examination division prepared a substitute for return (SFR) since the taxpayer did not file a required return for the year; in this case, the CP22E Notice indicates the IRS’ assessment of tax for the tax year based on the SFR it prepared.

Here is a Notice CP22E that the IRS sent one of our clients after the preparation of an SFR.

Table of Contents

IRS Notice CP22E At a Glance

| Letter Type: | Adjustment Notice |

| Generated By: | IRS Service Center |

| Preceded By: | Audit or SFR Preparation |

| Followed By: | Collections Activity |

| Recommended Action: | Audit Reconsideration OR Enter Into Resolution for Amount Due |

IRS Notice CP22E Explained, Part by Part

Here is a full explanation of the Notice CP22E, part by part.

Part 1: Billing Summary

On the first page of the CP22E Notice, the IRS gives a line-by-line summary of what they believe you owe.

This summary could include:

- The total amount of tax the IRS believes you owe, indicated as the “Amount you owed” line item

- The amount of any tax payments and credits on your account for the year — this is not included in the example image above because the taxpayer did not have any payments or credits on their account during the year

- The amount of any penalties the IRS has assessed on your account

- The amount of any interest the IRS has charged to your account

Part 2: Payment Coupon

At the bottom of the first page of the CP22E Notice is the payment coupon that you would submit with your payment if you intend to pay the amount on the notice in full.

Part 3: What the IRS Wants You to Do

Obviously, the IRS is sending you this notice because they want you to take some kind of action — namely, pay the amount they believe you owe them within 21 days.

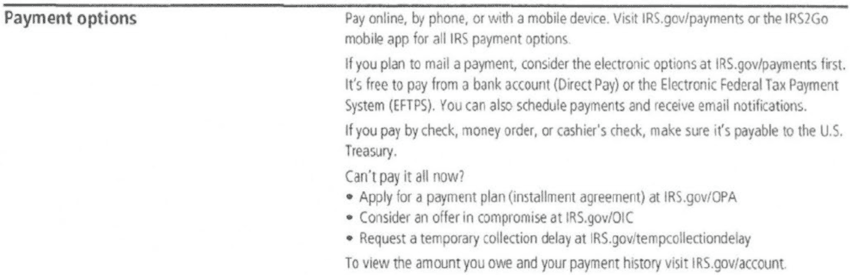

Part 4: Payment Options

Next, the IRS informs you of its payment options that you can find at irs.gov/payments or on the IRS2Go mobile app.

It also lets you know about potential tax resolution options, such as entering into an installment agreement, submitting an offer in compromise, or requesting CNC status.

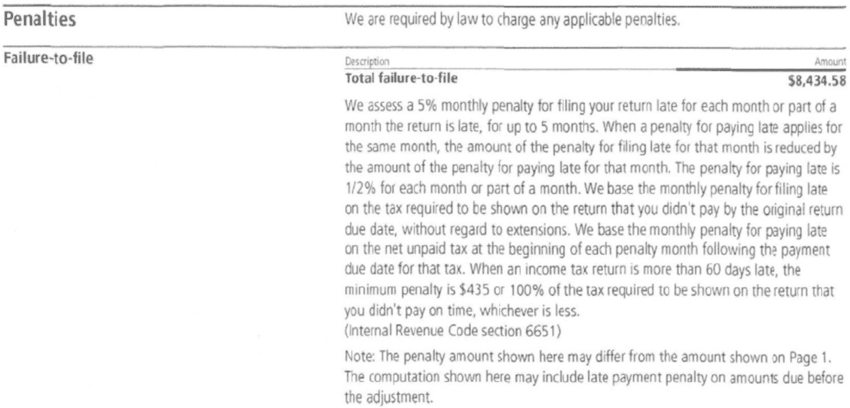

Part 5: Penalties

In the next section, the IRS explains the various penalties that it has assessed against you.

Failure-to-File Penalty

If the CP22E Notice you received is for an SFR prepared by IRS Examinations since you did not file your own tax return for the year, the IRS will have assessed you a failure-to-file penalty equal to five percent of the tax amount due (according to the SFR) per month or part of a month you failed to file your return after its deadline (up to a maximum of 25%).

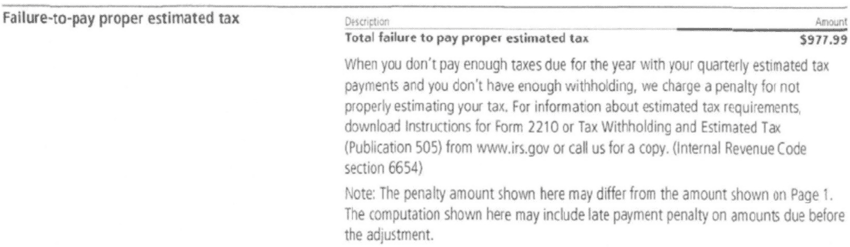

Underpayment of Estimated Taxes Penalty

The IRS expects to be paid the taxes it’s owed quarterly throughout the year; these are known as estimated tax payments.

So even if you pay the taxes you owe for the year by the following April 15 — thereby avoiding the failure-to-pay penalty — the IRS may still assess an underpayment of estimated taxes penalty against you if you did not make quarterly payments of taxes throughout the year.

Failure-to-Pay Penalty

The failure-to-pay penalty is a penalty that the IRS charges taxpayers who fail to pay their taxes for the year by their due date — typically April 15 of the following year.

The failure-to-pay penalty is equal to 0.5% of the unpaid tax amount per month or part of the month the taxes are unpaid, up to a maximum 25% penalty.

Note that if a taxpayer is liable for both the failure-to-file penalty and the failure-to-pay penalty for a given month, the IRS reduces the failure-to-file penalty for that month by the amount of the failure-to-pay penalty.

Part 6: Information on Penalty Removal or Reduction

The IRS does allow for full or partial penalty abatement in certain circumstances — in the next section of the CP22E Notice, they provide some basic information about this process.

Part 7: Interest Charges Calculation

The IRS then breaks down the interest they have charged you by quarter.

Part 8: Additional Information

Finally, at the very end, the CP22E Notice includes some additional information for you, such as:

- The official IRS webpage for the CP22E Notice

- Where you can obtains tax forms, instructions, and publications

- How to contact the IRS

- That you should keep your CP22E Notice for your records

What You Should Do If You Receive a CP22E

Below are the steps you should take after you receive a CP22E Notice.

For more information about each of these steps, check out our article How to Fight the IRS and Win.

Step 1: Consider audit reconsideration.

You received the CP22E Notice because the IRS audited you — either via a “traditional” audit of a return you filed or via the preparation of a substitute for return (SFR) because you did not file a return for the year.

Therefore, if you disagree with the results of the IRS audit that resulted in the balances due on the CP22E Notice, consider submitting an audit reconsideration request to the IRS.

Step 2: Seek Penalty Abatement.

For most of our clients with penalties on their account, we at least seek some sort of penalty relief for them.

Sometimes the IRS grants it; sometimes they don’t.

But it’s generally at least worth a shot.

For more information about seeking abatement for the penalties on your account, check out this article.

Step 3: Pay the Balance Due OR Seek Tax Relief

Finally, you have to figure out what to do with the amount you owe the IRS after you’ve cleared up any disagreements with them concerning the amount as well as obtained any possible penalty relief for your account.

You can, of course, pay off your balance in full. This will (obviously) stop future penalties and interest from accruing.

However, a better option — if you qualify for it — is an offer in compromise. An offer in compromise is an agreement you make with the IRS in which the IRS agrees to accept a lower amount to satisfy your tax debt than you actually owe.

That said, not all taxpayers qualify for an offer in compromise, so there are other options, such as a temporary hardship placement called currently not collectible status as well as installment agreements for taxpayers who wish to pay their balance over time.

For an overview of how tax relief works, read our article What Is Tax Relief and How Does It Work?.