IRS Notice CP523: What To Do When the IRS Threatens to Terminate Your IA

IRS Notice CP523 is the Installment Agreement Default Notice with Intent to Levy that the IRS sends to a taxpayer when it believes that the taxpayer has broken one or more of the terms of their IRS installment agreement.

Since the CP523 Notice typically serves as a Notice of Intent to Levy that the IRS must send a taxpayer before levying their state income tax refund under Section 6331(d) of the Internal Revenue Code, the IRS generally sends this notice via certified mail as required by the statute.

The IRS sends this notice to a taxpayer when it believes that the taxpayer has done one of the following things:

- Failed to make a monthly payment according to the terms of the installment agreement

- Failed to pay additional federal tax owed after entering into the installment agreement

- Failed to provide an updated financial statement when requested by the IRS

The Notice CP523 is notice-specific, so if the taxpayer’s installment agreement covered multiple tax years, the IRS would send a separate CP523 for each tax year.

Here is a Notice CP523 that the IRS sent one of our clients for failure to pay additional tax owed after entering into the installment agreement. You can see a similar Notice CP523 for another tax year here.

Here is a Notice CP523 that the IRS sent one of our clients for failure to provide an updated financial statement when requested by the IRS. You can see a similar Notice CP523 for another tax year here.

Table of Contents

IRS Notice CP523 At a Glance

| Letter Type: | Notice of Intent to Levy |

| Generated By: | IRS Service Center |

| Preceded By: | N/A |

| Followed By: | Collections Activity |

| Recommended Action: | Cure IA Default Condition, Restructure IA, or Seek Alternative Resolution |

IRS Notice CP523 Explained, Part by Part

Here is a full explanation of the Notice CP523, part by part.

Part 1: Reason for Termination Intent and Billing Summary

On the first page of the CP523 Notice, the IRS tells you why it is intending to terminate your installment agreement.

In the case of the sample CP523 Notice pictured above, the reason for the IRS’s intent to terminate is that the taxpayer failed to pay additional federal taxes that became due after he or she entered into the installment agreement.

The reason indicated in this section of the CP523 Notice may differ if the IRS’s intent to terminate is based on a different default condition than failure to pay additional federal taxes.

On the right-hand side of this section, the IRS provides you with a line-by-line summary of what they believe you owe.

This summary could include:

- The total amount of tax the IRS believes you owe, indicated as the “Amount you owed” line item

- The amount of any tax payments and credits on your account for the year — this is not included in the example image above because the taxpayer did not have any payments or credits on their account during the year

- The amount of any penalties the IRS has assessed on your account

- The amount of any interest the IRS has charged to your account

Part 2: Payment Coupon

At the bottom of the first page of the CP523 Notice is the payment coupon that you would submit with your payment if you intend to pay the amount on the notice in full.

Part 3: Notice of Intent to Levy (Light Explanation)

In this section — typically at the top of the second page of the CP523 Notice — the IRS gives you a brief description of what it means that this notice is a “notice of intent to levy.”

In IRS speak, “levy” is the term for seizing your assets — typically non-physical assets such as bank accounts or streams of cash inflows such as wages or income tax refunds.

In this section, the IRS informs you that if the IRS terminates your installment agreement, and you do not successfully appeal the termination, the IRS may levy your state income tax refund as well as other assets.

If the IRS has previously given you notice of your Collection Due Process (CDP) Hearing rights with respect to the tax year in the CP523 Notice, it has the ability to levy a wide range of your assets and income — see Part 5 below for a fuller explanation.

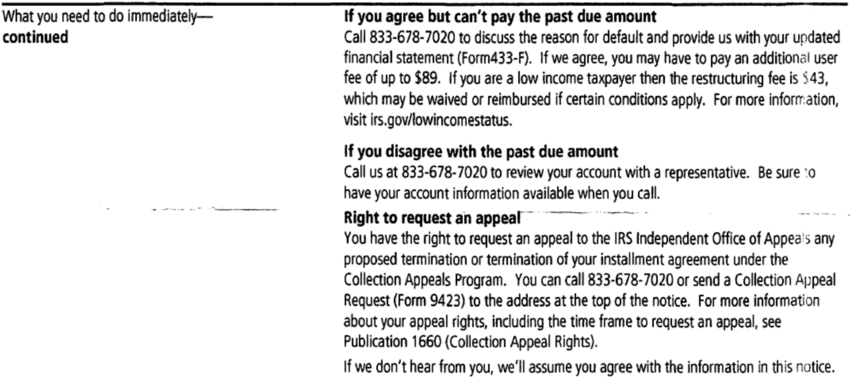

Part 4: What the IRS Wants You to Do

In this section, the IRS informs you what it wants you to do in various situations.

Essentially, your options boil down to these:

- Cure the default condition: For the sample CP523 Notice pictured above, this would mean paying the outstanding federal taxes owed.

- Provide updated financial information to the IRS: If you can prove to the IRS that you don’t have the means to cure the default condition — in this case, this would mean that paying the additional federal taxes would cause you economic hardship — the IRS may agree to restructure your installment agreement to include these additional taxes owed that were not included in your original installment agreement. This process starts with you providing updated financial information to the IRS, such as by providing them with an updated Form 433-F.

- Contest the additional federal taxes owed: If you don’t believe that you actually owe the additional federal taxes owed, you can call 833-678-7020 to discuss the situation with the IRS.

At any point in this process, you may appeal the IRS’s intent to terminate your installment agreement to the IRS Independent Office of Appeals. You would do this by sending a Collection Appeal Request (Form 9423) to the address on the top of your CP523 Notice.

Part 5: Notice of Intent to Levy (Fuller Explanation)

In this section, the IRS gives a fuller explanation than it did previously in the notice of what it means that the CP523 Notice is your Notice of Intent to Levy.

Remember, “levy” basically means the IRS forcibly seizing your assets or cash flow streams in order to satisfy your unpaid tax debt.

But before the IRS does this — before it “levies” you — it must give you sufficient notice.

The table below shows the three notices that the IRS must send you before levying you in its fullest capacity.

| Notice Name | Statutory Requirement | Typical Notices | IRS Levy Authority After Sending |

|---|---|---|---|

| Notice and Demand | IRC § 6303 | CP14 | None |

| Notice of Intent to Levy | IRC § 6331(d) | CP504, CP523 | Authority to Levy State Tax Refund |

| Final Notice of Intent to Levy and Notice of Right to a CDP Hearing | IRC § 6330(a) | LT11, Letter 1058 | Authority to Levy All Non-Exempt Assets and Income |

The CP523 Notice is a Notice of Intent to Levy — the second kind of notice in the table above. Upon sending this notice, and assuming you have not successfully appealed your installment agreement termination, the IRS may levy your state tax refund.

However, if the IRS has already sent you your Notice of a Right to a Collection Due Process (CDP) Hearing — such as a Letter LT11 — the IRS can levy your other assets and cash flow streams, such as:

- Wages and other income

- Bank accounts and other financial accounts

- Other assets and income streams, including Social Security benefits

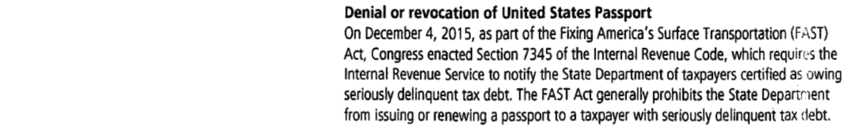

Part 6: Passport Denial or Revocation Information

In this section, the IRS describes its authority to certify your tax debt as “seriously delinquent” to the State Department — once this is done, the State Department will block your application to obtain or renew a United States passport and in certain cases may even revoke your passport entirely.

In order for tax debt to be considered “seriously delinquent,” it must meet all three of the requirements described in Internal Revenue Code Section 7345(b):

- The tax must have been assessed (which yours has if you were in an installment agreement for it).

- The tax must be greater than $50,000 (note that this amount is updated annually for inflation, and the amount is $59,000 for 2023).

- A notice of federal tax lien has been filed with respect to the tax or the IRS has taken levy action against you with respect to the tax.

Part 7: Payment Options

In this section, the IRS informs you of the ways you can pay the tax you owe.

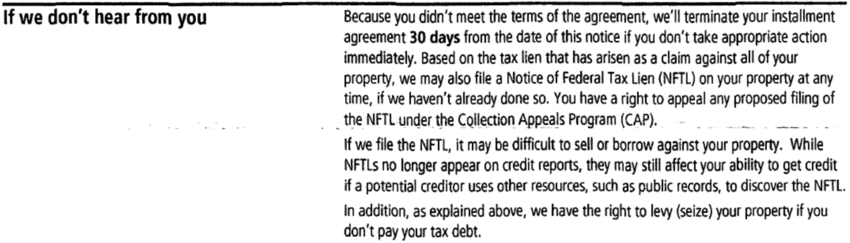

Part 8: What the IRS Says They Will Do If You Don’t Respond

In this section, the IRS informs you what will happen if you don’t respond to the CP523 Notice, namely that:

- The IRS will terminate your installment agreement if you don’t remedy the situation within 30 days of the date of the CP523 Notice.

- The IRS may file a Notice of Federal Tax Lien against you.

Part 9: Additional Information

In this section, the CP22E Notice includes some additional information for you, such as:

- The official IRS webpage for the CP523 Notice

- Where you can obtains tax forms, instructions, and publications

- How to contact the IRS

- That you should keep your CP523 Notice for your records

Part 10: Taxpayer Advocate Service and Low-Income Taxpayer Clinics Information

Next, the IRS gives you information about two resources that may be of interest to you: the Taxpayer Advocate Service (TAS) and Low-Income Taxpayer Clinics (LITCs).

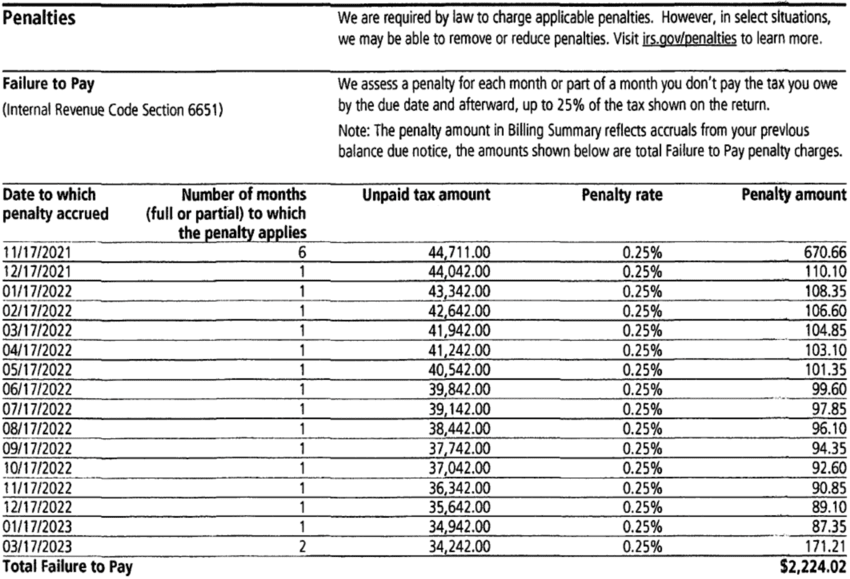

Part 11: Penalties Information and Calculation

In the next section, the IRS informs you of the penalties that the IRS has assessed against you as well as the calculation of the penalty amounts.

Common penalties include:

- Failure-to-file penalty: This is a penalty the IRS charges taxpayers for when they do not file their tax return on time. It is calculated as 5% of the balance due per month or part of a month that the tax return is late (up to a maximum of five months or 25% of the balance due).

- Failure-to-pay penalty: This is a penalty the IRS charges taxpayers for when they do not pay their taxes by their due date, which is typically their unextended tax return deadline. It is calculated as 0.5% of the balance due per month or part of a month that the taxes are unpaid (up to a maximum of 50 months or 25% of the balance). If both the failure-to-file penalty and the failure-to-pay penalty apply for a given month, the failure-to-file penalty is reduced by the failure-to-pay penalty for that month.

- Underpayment of estimated tax penalty: This is a penalty the IRS charges taxpayers for when they do not pay their quarterly estimated tax payments throughout the year.

Read this article for information about how to contest your IRS penalties.

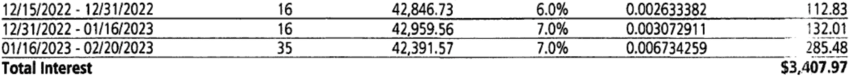

Part 12: Interest Information and Calculation

In this section, the IRS breaks down the interest it charged you since your tax was due.

Note that IRS interest is compounded daily and subject to change quarterly.

What You Should Do If You Receive a CP523

Below are the steps you should take after you receive a CP523 Notice from the IRS.

Step 1: Confirm that you’ve actually met the default condition.

It’s probably no surprise to you that the IRS makes mistakes from time to time, so the first thing you should do is make sure that the reason the IRS is intending to terminate your installment agreement and levy you is true.

If the IRS is saying that you didn’t pay additional federal taxes that you owe — is that true? Did you actually file a return and not pay the balance on it?

If the IRS is saying that you didn’t respond to their request for updated financial information — is that true? Did you actually not respond?

So read that first part of the CP523 Notice closely, note what default condition the IRS is pinning you for, and confirm that the IRS is correct on that point.

Step 1a: Dispute the default condition if the IRS is in error.

And then naturally, if you’ve confirmed that the IRS is in error here with the reason it’s given you for its intent to terminate your installment agreement in the CP523 Notice, contact the IRS at the number on the notice and tell them why you think they’re wrong.

This will likely not be a one-phone-call ordeal; you will likely explain your position to them; and then they’ll want to review your account.

But this is your right to do this, and we do this for our clients sometimes because frankly the IRS does from time to time make mistakes in thinking a taxpayer met a default condition on their installment agreement when they actually didn’t.