IRS Notice CP14: What It Is and How to Respond

IRS Notice CP14 is a Notice of Tax Due and Demand for Payment. It is the most common notice that the IRS sends out to taxpayers and, if not responded to within five weeks, is typically followed by the CP501 Notice.

The CP14 is the notice described in Internal Revenue Code § 6303, which requires the IRS — within 60 days of assessing a tax — to send taxpayers a notice of how much tax they owe and demand that they pay it.

If the IRS levies you without sending you the CP14 or an equivalent notice and demand — as well as the CP504 or an equivalent notice of intent to levy and the LT11 or an equivalent Final Notice of Intent to Levy and Your Right to a Hearing — the levy is improper and you should contest the levy.

Note, of course, that the IRS may be sending you notices at an old address!

Table of Contents

IRS Notice CP14 At a Glance

| Notice Type: | Collections |

| Generated By: | IRS ACS |

| Preceded By: | N/A |

| Followed By: | Notice CP501 |

| Recommended Action: | Enter Into Resolution |

IRS Notice CP14 Explained, Part by Part

Here is an explanation of the Notice CP14, part by part.

Part 1: Billing Summary

In this part of the CP14 Notice, the IRS breaks down for you the total amount they believe you owe. This breakdown could include items such as:

- Your total tax liability as indicated on the tax return you filed or as corrected by the IRS

- Payments and credits on your account for the tax year

- Penalties assessed by the IRS, such as the failure-to-file penalty, failure-to-pay penalty, and/or failure-to-pay estimated tax penalty

- Interest charges

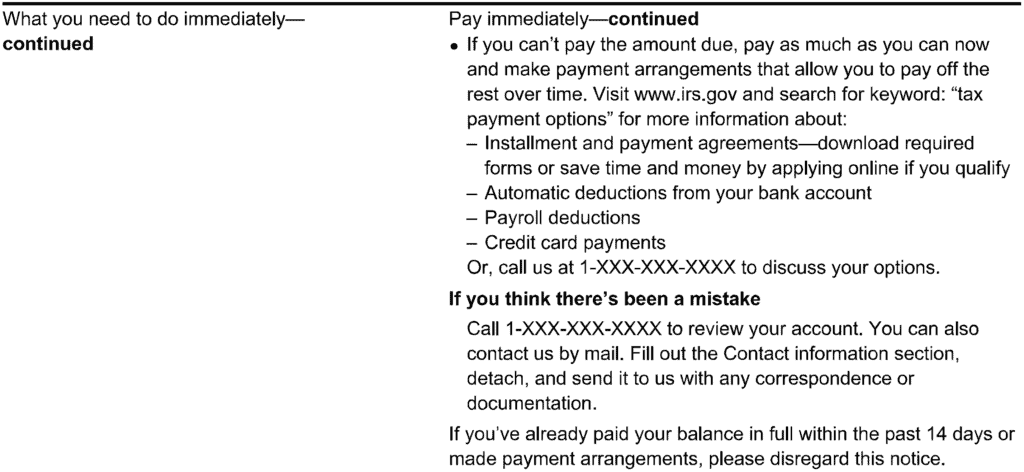

Part 2: What the IRS Wants You to Do

Next, the IRS tells you what they want you to do “immediately”: pay the amount indicated on the notice within 21 days if the amount you owe is less than $100,000 and within 10 days if the amount you owe is $100,000 or more.

The IRS also mentions the possibilities of paying off your balance via an installment agreement and gives some instructions on what to do if you think the IRS made a mistake in the CP14 Notice.

Part 3: What the IRS Says They Will Do If You Don’t Respond

Next, the IRS tells you what they will do if you don’t respond, namely, continue to charge you penalties and interest.

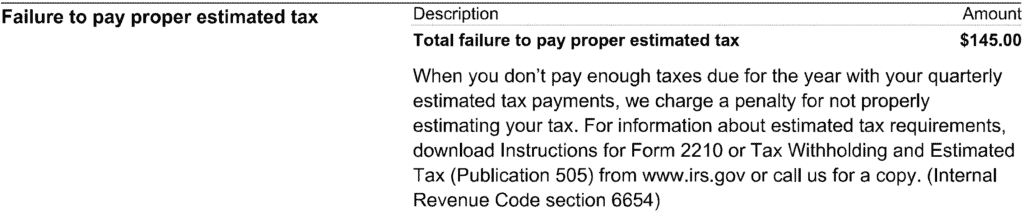

Part 4: Penalty Calculations

Next, the IRS gives you a breakdown of how they calculated the penalties listed out in Part 1 (the billing summary).

Failure-to-File Penalty

As it sounds, the failure-to-file penalty is assessed when you fail to file your tax return by the original due date of the return or, if you filed a valid extension of time to file your return, by the extended due date of the return.

This penalty is calculated as 5% of the tax due shown on the return per month or part of the month your return is late, up to a maximum of five months.

Failure-to-Pay Penalty

The failure-to-pay penalty is assessed when you fail to pay the taxes you owe by their due date — generally April 15 of the following year for most individual taxpayers.

This penalty is calculated as 0.5% of the tax you owe per month or part of the month you have an outstanding balance, up to a maximum of 50 months.

Failure to Pay Estimated Tax Penalty

The IRS expects you to pay your tax liability in four equal installments throughout the year; these payments are known as your estimated tax payments.

And if you don’t pay in your taxes throughout the year, the IRS may impose a failure to pay proper estimated tax penalty on you.

Part 5: Information on Penalty Removal or Reduction

Next, the IRS gives some basic information on how to possibly contest the penalties you have been charged.

Part 6: Interest Charges Calculation

Last but not least, the IRS shares with you how they calculated your interest charges.

When the IRS Sends Notice CP14

Here is the most common situation in which the IRS will send you Notice CP14:

- You filed your tax return for the year in question.

- You did not pay, in full, the amount due indicated on the tax return, including penalties and interest.

However, there are other situations in which the IRS may send you Notice CP14.

For example, if you filed your Form 1040 after the due date and paid the tax indicated along with the return, you may think that you do not owe the IRS any money.

However, because you filed your return and paid your taxes late, the IRS will likely have assessed both a failure-to-pay penalty and a failure-to-file penalty, thus creating a balance due. The IRS will likely also have charged interest to your account for the late payment.

In this case, even though you paid to the IRS the tax liability indicated on your return, you may still have a balance due on your account for the year due to the penalties and interest, and therefore the IRS may send you a Notice CP14 for the year.

Finally, the IRS may have sent you a Notice CP14 in error, such as if you paid the tax due indicated on your return timely but the IRS did not properly credit your payment to your account.

What You Should Do If You Receive a CP14 Notice

Below is how you should respond to a CP14 Notice, step by step.

For more information about each of these steps, check out our article How to Fight the IRS and Win.

Step 1: Check the CP14 Notice for accuracy.

It shouldn’t be any surprise to you that the IRS can make mistakes from time to time, so be sure to review the IRS’s calculations on the CP14 Notice and make sure that everything looks accurate to you.

Step 2: Correct any errors with the IRS.

If you find something you disagree with, take it up with the IRS.

The CP14 Notice itself provides you with the phone number you should call if you disagree with something in the notice.

Obviously, getting through to the IRS right now is very difficult, so feel free to reach out to us at 866-8000-TAX if you’d like us to get through to the IRS for you — our staff is on the phone with the IRS all day.

Step 3: Seek Penalty Abatement.

Now that you’ve checked the CP14 Notice for accuracy and either 1) found it to be accurate or 2) corrected any inaccuracies with the IRS, you should at least try for penalty abatement.

Penalty abatement is a big topic, and we’ve covered it in depth in this article.

Step 4: Pay the Balance Due OR Seek Tax Relief

At this point, you and the IRS should be in agreement as to how much you owe (assuming there’s still a balance remaining after you’ve taken steps 1-3).

Now you have to figure out how to deal with this balance.

First, you probably want to determine if you qualify for an offer in compromise. This is an agreement with the IRS to settle your debt for less than you owe.

If you don’t qualify for an offer in compromise, you have other options:

- Obtain a temporary pause on having to pay the IRS what you owe based on hardship — this is known as currently not collectible status.

- Set up an installment agreement with the IRS.

- Pay off your balance in full to avoid any future accrual of penalties and interest.

For an overview of how tax relief works, read our article What Is Tax Relief and How Does It Work?.

How to Pay Your CP14 Online

If you agree that you owe the amount due on your CP14 Notice and want to pay it all in full now, you can obviously send in a check with the voucher at the bottom of the first page of the notice itself.

But if you want to pay online, you can go to irs.gov/payments and select the payment method that works best for you.