IRS Notice CP59: What It Is and How to Respond

IRS Notice CP59 is the First Notice for Nonfiler Return Delinquency.

It is the first notice the IRS sends to a taxpayer to inform them that they have no record of a tax return filed for a particular year and is accompanied by Form 15103.

The Notice CP59 is typically sent within 12 months after a return’s due date.

If a taxpayer does not file the tax return or otherwise satisfy the Notice CP59 request within eight weeks of receipt, the IRS will generally send the taxpayer Notice CP516 or Notice CP518.

If Notice CP59 is returned to the IRS from the post office with a new address for the taxpayer, the IRS will send Notice CP515 to the new address.

The Notice CP59 is written in English; the Spanish equivalent is Notice CP759.

Table of Contents

IRS Notice CP59 At a Glance

| Notice Type: | Return Delinquency |

| Generated By: | IRS IMF |

| Preceded By: | Non-Filing of Tax Return |

| Followed By: | Notice CP516 or Notice CP518 |

| Recommended Action: | File Required Tax Return |

IRS Notice CP59 Explained, Part by Part

Here is a full explanation of the Notice CP59, part by part.

Part 1: Message About Your Form 1040

IRS Notice CP59 opens with the IRS informing the taxpayer that:

- The taxpayer didn’t file a tax return for the year the notice pertains to.

- If they’re required to file a tax return for this year to do so immediately.

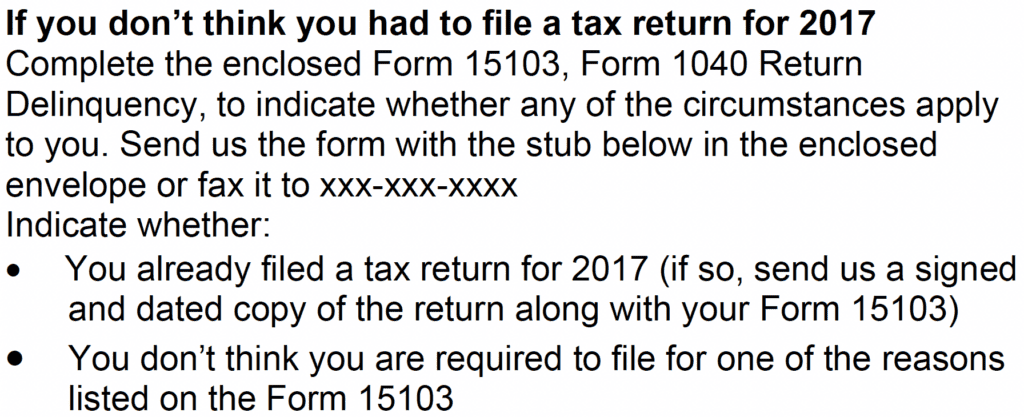

Part 2: If You Don’t Think You Had to File a Tax Return

The IRS then informs the taxpayer what they should do if they don’t think they had to file a tax return for the year in question or if they already filed a tax return for the year in question, namely, to complete the Form 15103 that accompanies the Notice CP59.

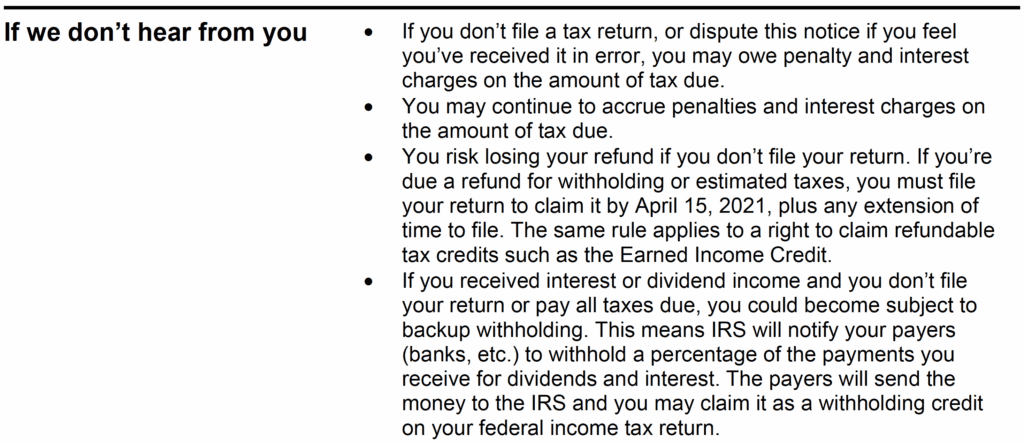

Part 3: What the IRS Says They’ll Do If You Don’t Respond

In the next section of the Notice CP59, the IRS informs the taxpayer what they intend to do if the taxpayer does not respond to the notice.

If the taxpayer doesn’t file their tax return for the tax year the notice pertains to or otherwise dispute their requirement to file a tax return for that year, the IRS warns them that they may owe penalty and interest charges on the amount due for the year if they in fact have a balance due for the year.

And they say that even if the taxpayer doesn’t owe the IRS money but rather the IRS owes them money in the form of a tax refund for these years, the taxpayer will lose the ability to get that refund if they don’t file the tax return for the year on or before three years after the due date of their return or, if they filed an extension for the year, the extended due date of the return.

It’s interesting because one thing the IRS does not say here — which may happen eventually — is that the IRS may file what’s called a substitute for return (SFR) for the taxpayer if they don’t file their tax return.

And you generally don’t want that to happen because oftentimes on this SFR that they prepare for you the IRS grossly overcalculates your tax liability because they assume the least favorable filing status, that you have no deductions beyond the standard deduction, etc.

Related: Learn more about the IRS SFR process in this article.

Part 4: Next Steps

Part 5: Payment Options

Next, the IRS tells you your payment options on whatever debt you would owe for this tax year once you actually file your return (or the IRS files an SFR for you).

When the IRS Sends Notice CP59

The most common reason for the IRS sending you a Notice CP59 is when the following things happened:

- The IRS determined that you did not file a return by the due date despite the fact that you apparently received income — and the IRS would know you received income because it received tax forms about you from third parties such as Form W-2, Form 1099, Schedule K-1, etc.

- The IRS created a “Return Delinquency Case” for you. And as part of the IRS’s guidelines for individual return delinquency case creation found in Internal Revenue Manual Section 5.19.2.3(4), the IRS is to send the Notice CP59 to certain individuals when their return delinquency case is created.

What You Should Do If You Receive a Notice CP59

In most cases, the best thing to do when receiving a Notice CP59 from the IRS is to simply file your original tax return requested in the notice rather than waiting for the IRS to prepare an SFR for you and assess and attempt to collect taxes based on that SFR.

Now, if the year in question is from a while back, that may be easier said than done.

However, lucky for you, I have put together a guide to filing back tax returns that you can access by clicking here or by watching the video below!

Of course, if you still owe the IRS a balance due after filing your original return, you’ll need to figure out how you’re going to resolve this balance.

Now, you could simply pay whatever balance is owed in full along with penalties and interest.

But it’s generally at least worth seeing if you’ll qualify for any penalty abatement and if you really can’t pay what you owe at the moment see if you could qualify for some kind of tax relief option, such as an offer in compromise, some kind of installment agreement, being placed in currently not collectible status, or several others.

To learn more about these options, read this article about how to get IRS tax debt relief or watch the video below.