IRS Letter 3219N: What To Do If the IRS Calculated Your Taxes For You

IRS Letter 3219N is the 90-day letter issued by the IRS Automated Substitute for Return (ASFR) Program to a taxpayer after it has sent a 30-day letter (typically in the form of Letter 2566) that the taxpayer did not respond to.

As a 90-day letter, IRS Letter 3219N is a statutory notice of deficiency that, if not responded to within 90 days of the date on the letter itself, will result in the IRS assessing the taxes, penalties, and interest described in the letter.

Here is a sample Letter 3219N.

What Is Assessment?

The assessment of a tax is the formal recording of a taxpayer’s tax debt — including penalties and interest — in the government’s books, that is, its financial records.

Why does this matter to you? The main reason is because according to Internal Revenue Code § 6502 “Collection After Assessment”, the IRS must assess a tax before attempting to collect it from you — such as through wage garnishments or bank levies.

That is why the IRS actually assessing a tax is such a big deal because once a tax is assessed against you, the IRS has pretty awesome authority to collect it from you.

But assessment — the actual recording of your debt in the government’s books — must happen first.

Table of Contents

IRS Letter 3219N At a Glance

| Letter Type: | 90-Day Letter |

| Generated By: | IRS ASFR Program |

| Preceded By: | Letter 2566 |

| Followed By: | Assessment |

| Recommended Action: | File Original Return to Replace SFR |

IRS Letter 3219N Explained, Part by Part

Here is a full explanation of the Letter 3219N, part by part.

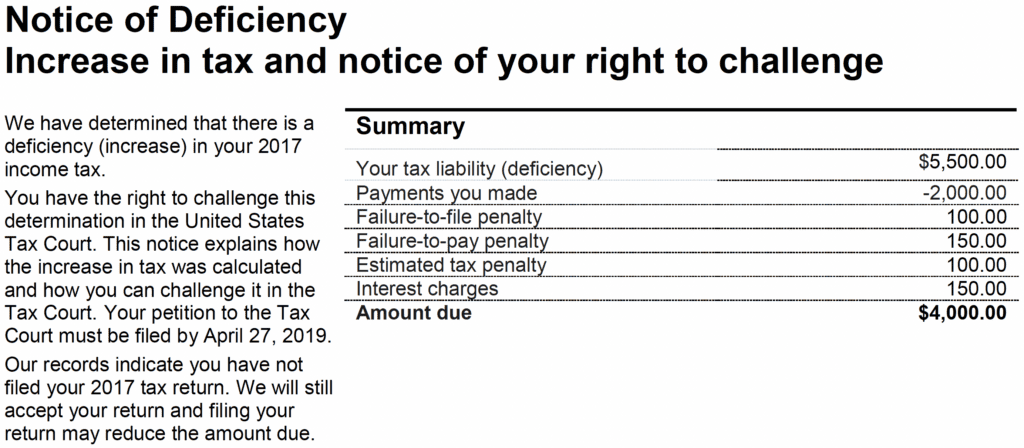

Part 1: Summary of Deficiency

At the very top of the first page of Letter 3219N, you’ll see a summary of the IRS’ deficiency determination against you.

In this part of the letter, the IRS breaks down for you the total amount they believe you owe. This breakdown could include items such as:

- Your total tax liability as indicated on the tax return you filed or as corrected by the IRS

- Payments and credits on your account for the tax year

- Penalties assessed by the IRS, such as the failure-to-file penalty, failure-to-pay penalty, and/or failure-to-pay estimated tax penalty

- Interest charges

To the left of the summary box is some more information about the notice itself as well as your right to challenge the IRS’ determination in Tax Court and the deadline to file your Tax Court Petition — which is 90 days from the date of the letter.

There is also a reminder that the IRS will still accept your originally filed return for the year to replace the IRS’ SFR.

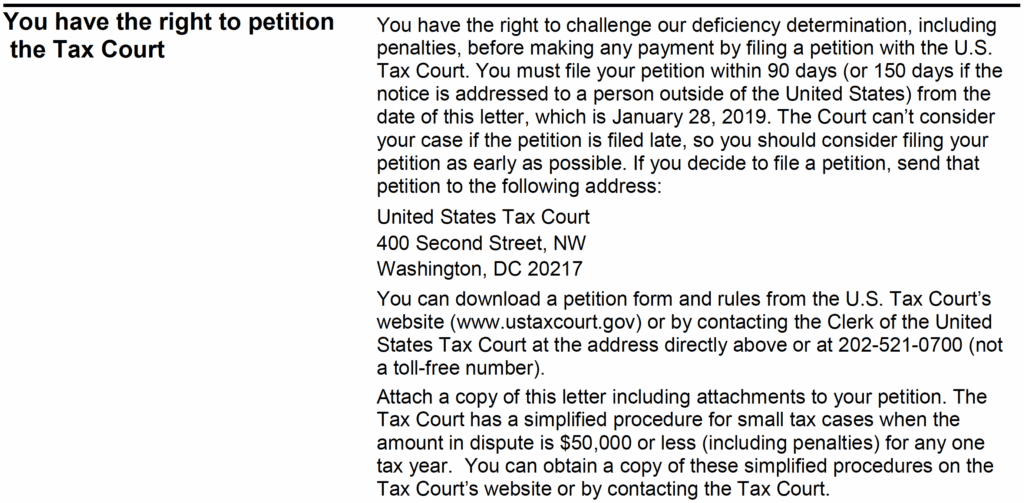

Part 2: Right to Petition the Tax Court

Next, the Letter 3219N informs you in more detail of your right to petition the United States Tax Court to challenge the deficiency before having to make any payment to the IRS.

If you chose to contest the IRS’ deficiency determination in Tax Court — which is not required (you can simply file your original return to replace the IRS’ SFR) — you must file a petition with the Tax Court within 90 days of the date in the upper-right-hand corner of your Letter 3219N. This deadline is extended to 150 days if your Letter 3219N is addressed to a person outside the United States.

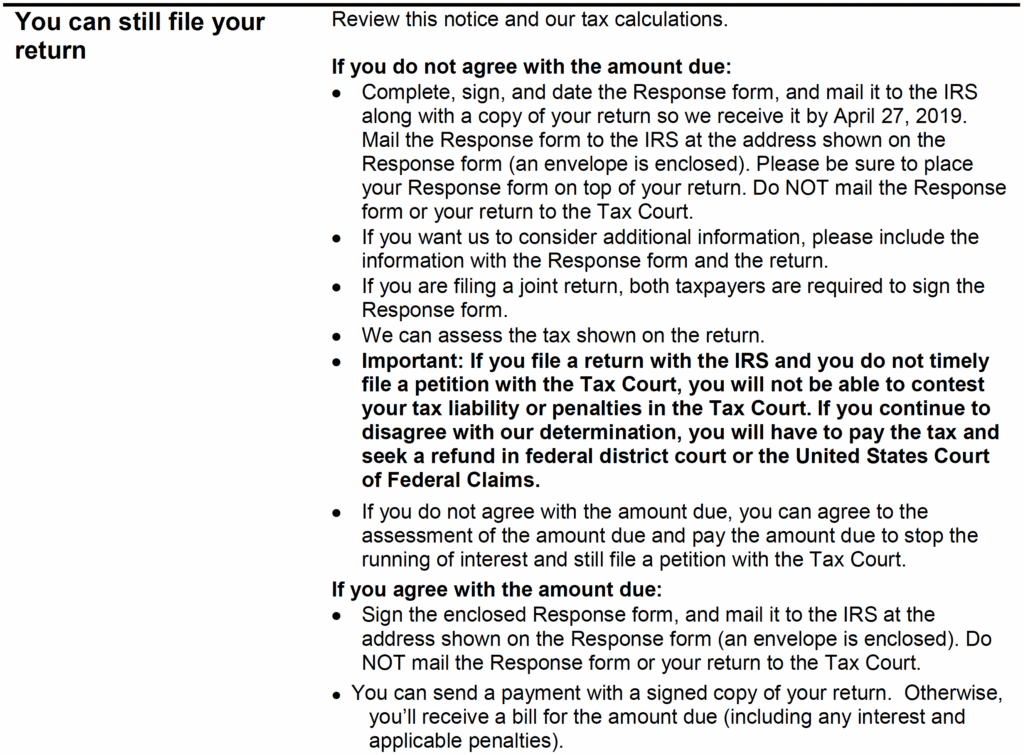

Part 3: Other Actions You May Take

In the next section of the Letter 3219N, the IRS gives you other courses of action you may take either instead of or in addition to filing a Tax Court petition.

So obviously if you don’t agree with the IRS’ SFR-driven deficiency on the Letter 3219N, you are probably going to file your original return to replace the SFR for this tax year.I

f that’s your plan, you simply complete the response form at the end of the Letter 3219N — your name and address are likely already there, but you would want to put your phone number on there as well in addition to the best time to call you — and you would check the box on the response form stating that you are “enclosing a signed and dated copy of [your] tax return.”

In doing this, you are submitting your return to the government, and agreeing that they may assess the tax shown on your return in addition to penalties and interest.

You can also submit to the IRS additional information to consider in addition to the tax return itself.

Whatever you do, if you do not agree with the IRS proposed deficiency, do not check the box on the second page of the response form that says, “I consent to the immediate assessment and collection of the deficiency and any penalties determined in this notice, along with applicable interest.” Do not sign it.

If any of this is confusing to you, reach out to a tax professional like us at Choice Tax Relief by calling 866-8000-829 — we’ve dealt with countless numbers of these 90-day letters before.

Part 4: What Happens If You Don’t Respond

In summary, this section states that the IRS will assess the tax liability plus penalties and interest shown in the summary of deficiency on the first page unless you contest the deficiency within 90 days by either filing an original return for the year or filing a petition in Tax Court.

Part 5: Tax Calculations

In this section, the IRS informs you how it calculated your tax due.

Your Income

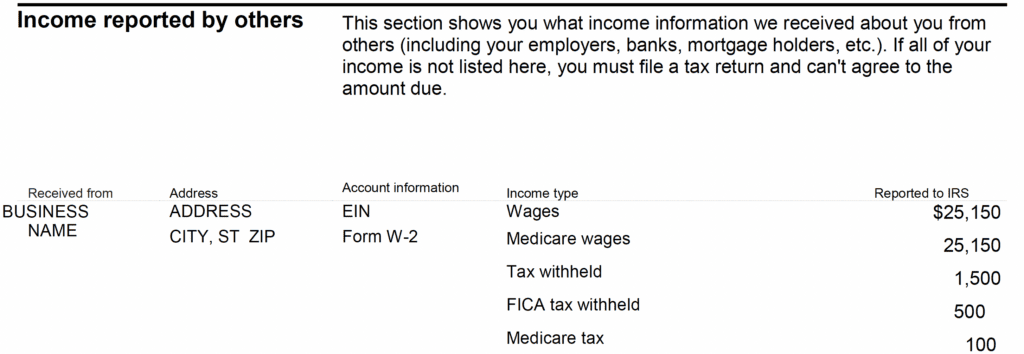

The IRS starts by breaking down your income as reported to them on documents filed with the IRS by others.

So the $25,150 wages figure here is directly off a W-2 form that this taxpayer’s employer issued to the taxpayer and filed with the IRS.

The $500 in dividends is from a 1099-DIV that a stock brokerage company, most likely, issued to the taxpayer and filed with the IRS.

The other income is probably something else that was reported on a 1099-MISC or some other tax form.

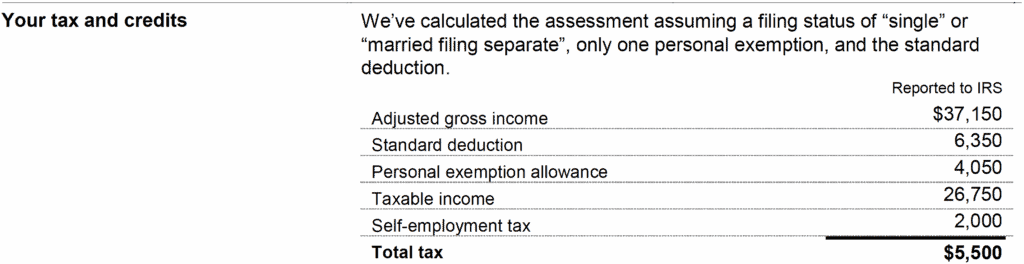

Your Tax and Credits

Then the IRS takes that income figure and shows you in some detail how it calculates your tax liability on that income.

And they let you know at the top of this part that they are making three and really four assumptions:

- That if the IRS believes you to be unmarried that it’s calculating your tax liability based on the “single” filing status and if the IRS believes you to be married that it’s calculating your tax liability based on the “married filing separate” filing status.

- That it’s only giving you one personal exemption — and of course personal exemptions only existed for tax years before 2018.

- That it’s giving you the standard deduction and assuming you have no itemized deductions.

- And this isn’t explicitly stated here, but the IRS is also assuming — if you have a business — that you incurred no business expenses.

So it walks you through the calculation there of adjusted gross income — which on SFRs is the same as the total income calculated in the previous part — less the standard deduction for either the single or married filing separate filing status (depending on whether the IRS believed you to be married for the year) less your personal exemption allowance (of course this was only a thing for tax years before 2018).

And the result is of course your taxable income. It doesn’t show you how it calculates your tax on your taxable income —but basically you could probably figure that out yourself by looking at the tax tables for the year — and to that it adds any self-employment tax liability that the IRS calculated for you if you had 1099-NEC income or in the old days 1099-MISC income with something in the “Nonemployee compensation” box.

It adds the regular tax liability to the self-employment tax liability to yield your total tax liability for the year.

Your Payments and Net Tax Due

And then in the next part, the IRS shows you what it believes to be the payments you made for the tax year — such as through wage withholding, estimated tax payments, possibly credits from other tax periods, extension payments, etc. — and it subtracts those total payments from your tax liability calculated in the previous part to yield your net tax due.

Part 6: Income Reported by Others

In the next section, the IRS discloses the income reported to it by others, such as on Forms W-2, 1099, K-1, etc.

Part 7: Penalty Calculations

Next, the IRS gives you a breakdown of how they calculated the penalties listed out in Part 1 (the summary of deficiency).

Failure-to-File Penalty

As it sounds, the failure-to-file penalty is assessed when you fail to file your tax return by the original due date of the return or, if you filed a valid extension of time to file your return, by the extended due date of the return.

This penalty is calculated as 5% of the tax due shown on the return per month or part of the month your return is late, up to a maximum of five months.

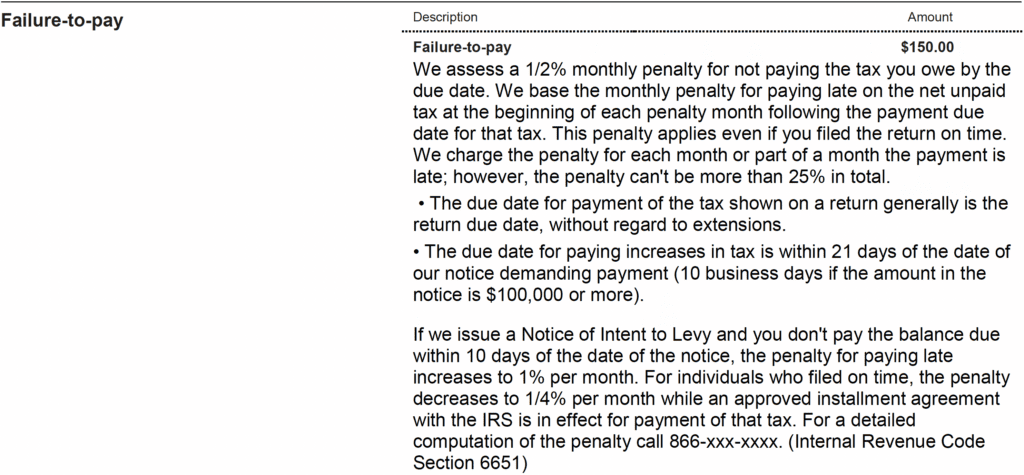

Failure-to-Pay Penalty

The failure-to-pay penalty is assessed when you fail to pay the taxes you owe by their due date — generally April 15 of the following year for most individual taxpayers.

This penalty is calculated as 0.5% of the tax you owe per month or part of the month you have an outstanding balance, up to a maximum of 50 months.

Failure-to-Pay-Estimated-Tax Penalty

The IRS expects you to pay your tax liability in four equal installments throughout the year; these payments are known as your estimated tax payments.

And if you don’t pay in your taxes throughout the year, the IRS may impose a failure to pay proper estimated tax penalty on you.

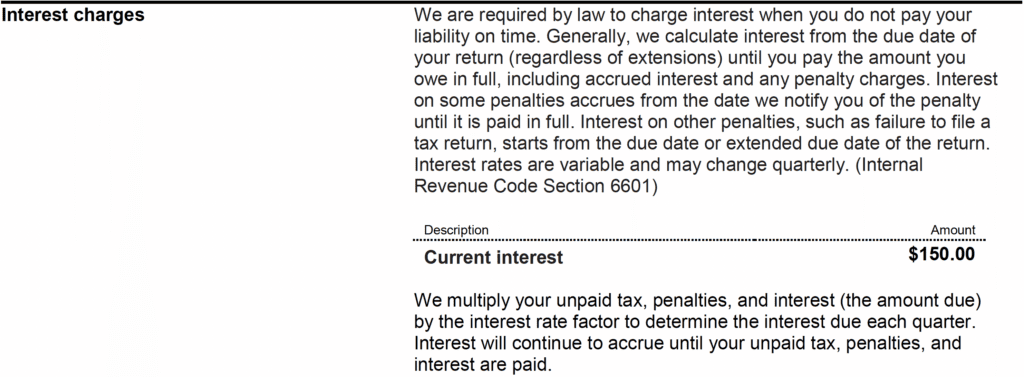

Part 8: Interest Charges

In the next section, the IRS shares with you how they calculated your interest charges.

Part 9: Response Form

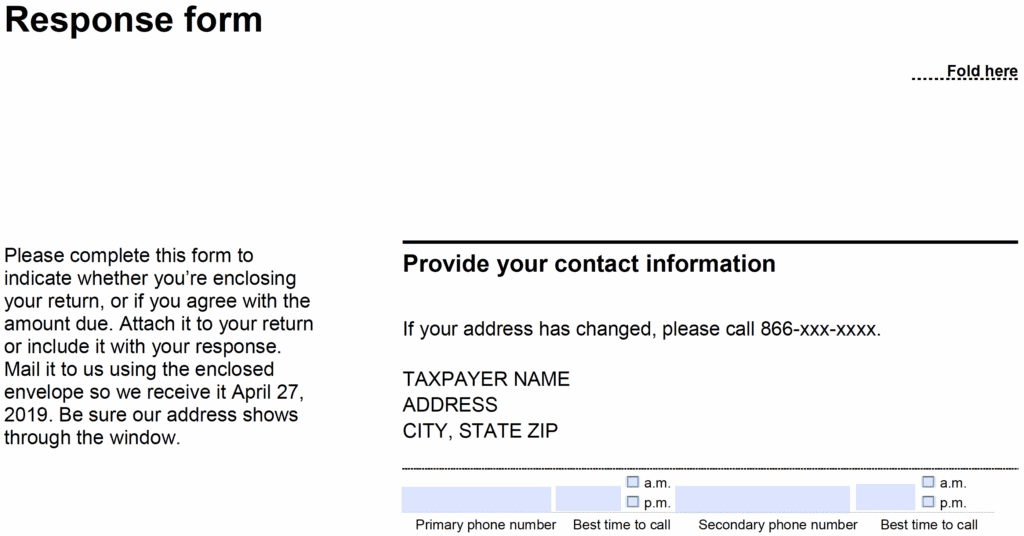

The last part of Letter 3219N is the response form. You would complete this response form in two situations:

- You are going to submit to the IRS your original return.

- You agree with the IRS’s deficiency and consent to immediate assessment of the IRS’s deficiency, which includes taxes, penalties, and interest.

So if either of those two situations apply to you, make sure your name and address are correct in the section of the response form titled “Provide your contact information” and fill in your phone number and best time to reach you as well.

“I’m Enclosing My Return”

If your plan is to submit your original return to the IRS, go ahead and check the box that says you are enclosing a signed and dated copy of your return and mail both back to the IRS.

“I Agree With the Amount Due”

In the unlikely event that you agree with the amount due — and I really wouldn’t recommend doing this until you get a professional opinion first — check the consent box and then sign and date.

“Indicate Your Payment Option”

And if you do intend to start making payments to the IRS, you would indicate your payment option in the “Indicate your payment option” section, but again, I would recommend discussing your Letter 3219N with a tax professional before making payments to the IRS on this deficiency.

When the IRS Sends Letter 3219N

The most common reason for the IRS sending you a Letter 3219N is when the following things happened:

- You did not file your tax return for the tax year mentioned on the letter and therefore the IRS

- The IRS Automated Substitute for Return (ASFR) Program prepared a substitute for return (SFR) for this year for you. You can learn more about the SFR program in this article.

- The IRS Automated Substitute for Return (ASFR) Program issued you a 30-day letter in the form of Letter 2566 to which you did not respond.

What You Should Do If You Receive a Letter 3219N

In most cases, the best thing to do when receiving a Letter 3219N from the IRS is to simply file your original tax return to replace the IRS ASFR Program’s SFR.

Now, if the year in question is from a while back, that may be easier said than done.

However, lucky for you, I have put together a guide to filing back tax returns that you can access by clicking here or by watching the video below!

Of course, if you still owe the IRS a balance due after filing your original return, you’ll need to figure out how you’re going to resolve this balance.

Now, you could simply pay whatever balance is owed in full along with penalties and interest.

But it’s generally at least worth seeing if you’ll qualify for any penalty abatement and if you really can’t pay what you owe at the moment see if you could qualify for some kind of tax relief option, such as an offer in compromise, some kind of installment agreement, being placed in currently not collectible status, or several others.

To learn more about these options, read this article about how to get IRS tax debt relief or watch the video below.

Should You File a Tax Court Petition?

Before I conclude this article, I do want to answer the question, “Should I file a Tax Court petition in response to receiving a Letter 3219N?”

Now, most cases with SFR filings — even after the Letter 3219N has been issued — can be resolved simply by filing the original returns.

That said, there may be — depending on your particular case — a reason to file a Tax Court petition before that hard 90-day deadline mentioned in the letter.

For example, if even after filing the original returns, you still have a large tax balance due with penalties and interest, filing a Tax Court petition may increase your odds of penalty abatement.

This is because when you petition the Tax Court, you don’t go straight to Tax Court; they kick your case to Appeals first.

And Appeals tends to be a bit more generous with penalty abatement than the IRS collections department.

And speaking of Appeals, another thing to keep in mind here — and this is probably getting a little too deep down the procedural rabbit hole here — but if you don’t file a Tax Court petition to contest the deficiency, you won’t be able to dispute the tax liability before IRS Appeals in the future because you had a previous opportunity for Appeals consideration, i.e., via filing the Tax Court petition.

This may come into play if you’re taking a very aggressive position on your return or some position that the IRS could potentially challenge on the basis of tax law.

Also, another thing to keep in mind is that filing a Tax Court petition will typically buy you some more time before the IRS comes to collect. However, you should not file a Tax Court petitions simply as a means of delaying collection.

Have you received a Letter 3219N? Give us a call here at Choice Tax Relief at 866-8000-TAX to discuss with one of our tax consultants!