IRS Notice CP91: What It Is and How to Respond

IRS Notice CP91 is the notice that the IRS sends when it intends to garnish your Social Security benefits.

This notice is typically send after the IRS has sent the LT11 or at least the CP504 warning the taxpayer that their income and assets are subject to levy to pay their past-due income taxes.

Table of Contents

IRS Notice CP91 Explained, Part by Part

Here is a full explanation of the Notice CP91, part by part.

Part 1: Intent

![]()

On the first page of the CP91 Notice, the IRS tells you exactly what the notice is about: that it intends to seize up to 15% of your Social Security benefits.

Why 15%? Because that’s the maximum it’s allowed to take.

Read our article “Can the the IRS Garnish Social Security?” for more information.

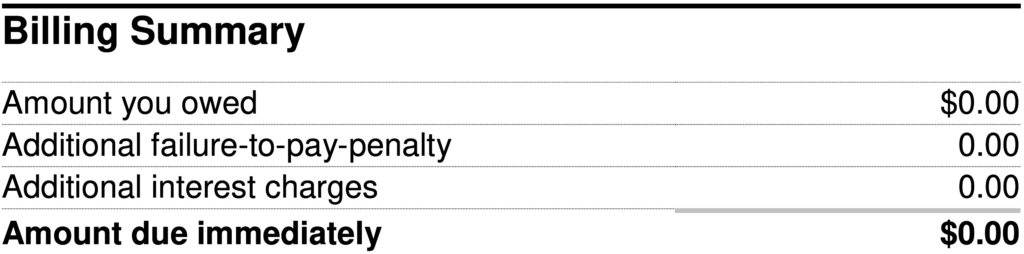

Part 2: Billing Summary

Here’s where the IRS tells you how much taxes, penalties, and interest it thinks you owe.

Note that in the sample CP91 Notice used in this article, the balance due is zero, but your notice will have some actual numbers here.

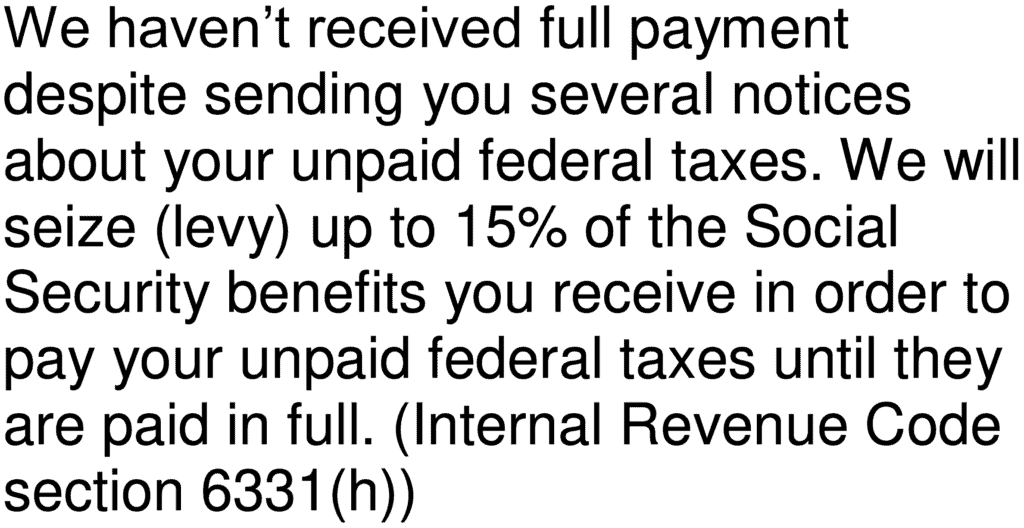

Part 3: Explanation For Notice

Below the “Intent” section and to the left of the “Billing Summary,” the IRS tells you why it sent this notice.

Basically, they’re saying that over the past few months they’ve sent you a series of notices about your federal tax debt — likely including notices such as the CP14 and CP501 — and, since you did not respond to them, they are sending you this Notice CP91 to inform you that they will be seizing up to 15% of your Social Security benefits to pay your tax debt.

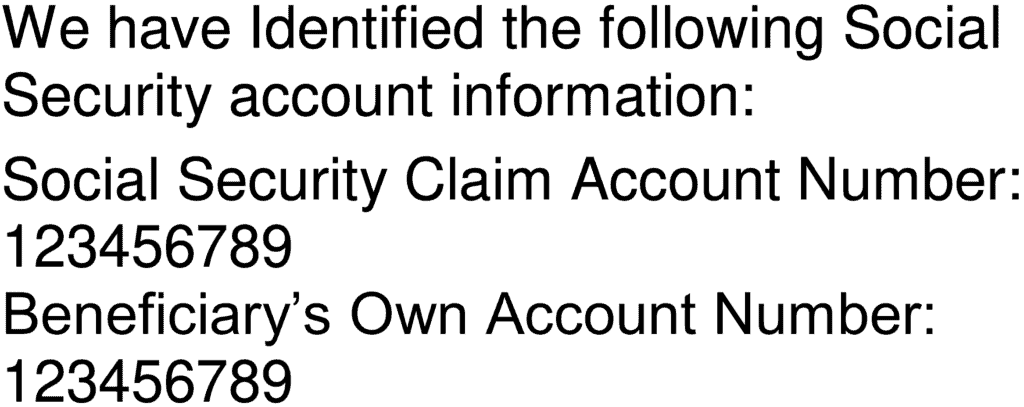

Part 4: Accounts in Question

Next the IRS tells you the specific Social Security claim account numbers and Beneficiary’s account numbers in question.

The first number — the “Social Security Claim Account Number” — is the Social Security number under which a Social Security claim is filed or benefits are paid.

The second number — the “Beneficiary’s Own Account Number” — is the Social Security number of the actual recipient of the benefits.

If you are receiving Social Security benefits based on your own work history and clam, these numbers should be the same; however, if you are receiving Social Security survivor’s benefits based on another individual’s work history and claim, these numbers could be different.

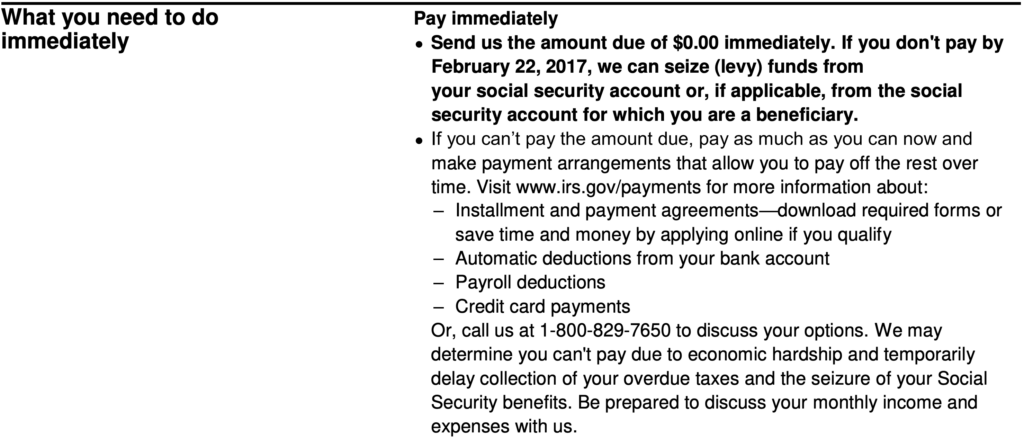

Part 5: What the IRS Wants You to Do

In the next section, the IRS informs you that if you don’t pay the amount due within 30 days or make other kind of payment arrangements — such as an installment agreement — then it will take money from your Social Security benefits.

Part 6: What the IRS Says They Will Do If You Don’t Respond

Next, the IRS informs you that if you don’t call them or pay the amount they claim you owe immediately, they will garnish your Social Security account.

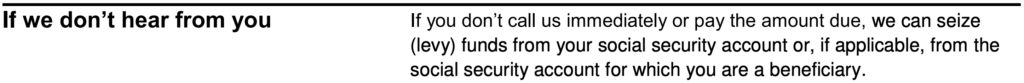

Part 7: Your Billing Details

Next, the IRS will break down your debt by period.

The “Amount you owed” column represents the taxes you owe for that year.

The “Additional interest” column represents the interest you owe for that year.

The “Additional penalty” column represents the penalties you owe for that year.

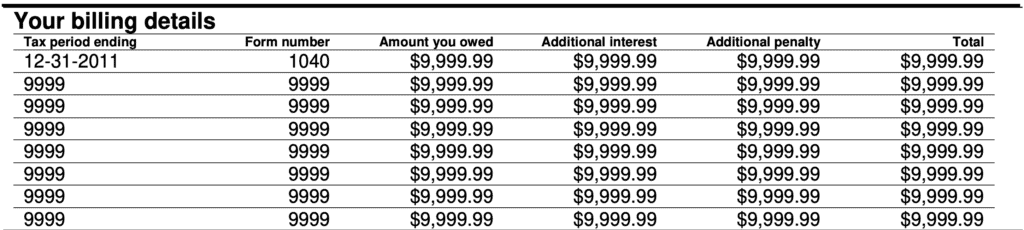

Part 8: Penalty Calculations

Next, the IRS lists out the penalties that it has assessed on you with a brief explanation of the penalties themselves.

In this example, the IRS has only charged the failure-to-pay penalty, but other common penalties you may see here are the failure-to-file penalty and the failure to pay estimated tax penalty.

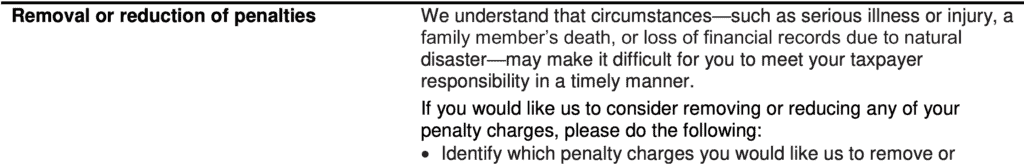

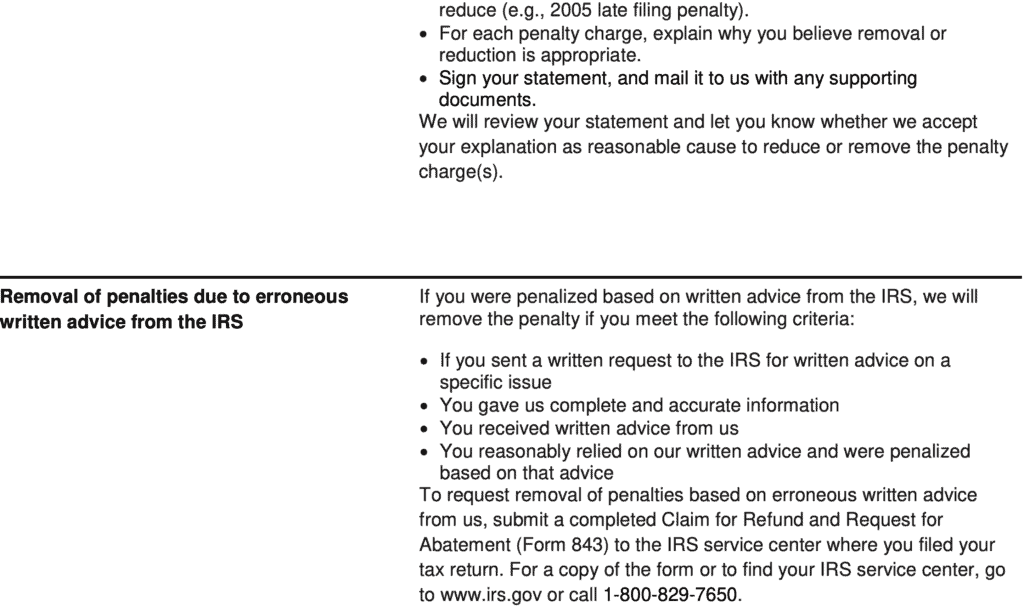

Part 9: Information on Penalty Removal or Reduction

The IRS does allow for full or partial penalty abatement in certain circumstances — in the next section of the CP91 Notice, they provide some basic information about this process.

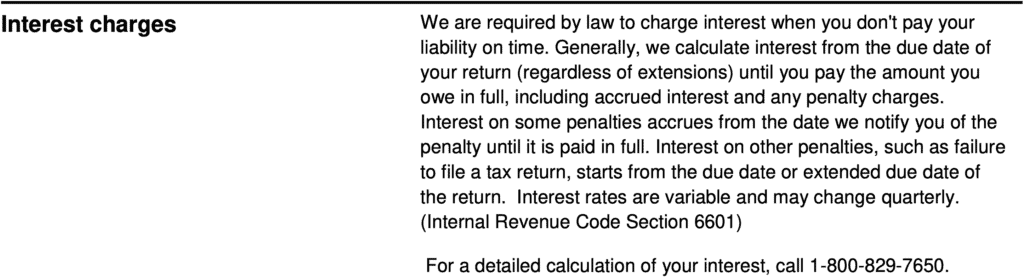

Part 10: Interest Charges Information

Finally, the IRS breaks down the interest they have charged you by quarter.

When the IRS Sends Notice CP91

The most common reason for the IRS sending you a CP91 Notice is when the following things happened:

- You filed a tax return for the year in question that indicated a balance due.

- You did not pay the amount due indicated on the return in full.

- The IRS previously sent you a CP14 Notice and you did not respond to it.

Another situation in which the IRS sends taxpayers a CP91 Notice is if the IRS itself prepared a substitute for return (SFR) for a taxpayer and the tax was assessed based on this SFR.

Or a taxpayer may have paid the balance due indicated on their return when they filed it — but they filed the return or at least paid the tax late, giving rise to penalties and interest that they have not yet paid.

Of course, the IRS is known to make mistakes, and it’s possible they are sending you the CP91 Notice in error because they didn’t properly credit your account for payments you made for the tax year.

What You Should Do If You Receive a CP91 Notice

Below are the steps you should take after you receive a CP91 Notice.

For more information about each of these steps, check out our article How to Fight the IRS and Win.

Step 1: Check the CP91 Notice for accuracy.

Don’t assume that the IRS did their math correctly — review the IRS’s numbers against your own.

Step 2: Correct any errors with the IRS.

If you do find an error in the IRS’s math, take it up with them.

There should be phone numbers in the CP91 Notice itself that you can call to discuss your disagreement with the IRS’s numbers:

- For example, in the “What you need to do immediately” section, there will likely be a phone number that you can call to “discuss your options.” If you disagree with the tax amount itself, call this number.

- In the “Penalties” section, there should be a number indicated that you can call to obtain a “detailed calculation of your penalty charges.” If you disagree with the IRS’s penalty calculation, call this number.

You can always reach out to us at at 866-8000-TAX to go to bat against the IRS for you.

Step 3: Seek Penalty Abatement.

For most of our clients with penalties on their account, we at least seek some sort of penalty relief for them.

Sometimes the IRS grants it; sometimes they don’t.

But it’s generally at least worth a shot.

For more information about seeking abatement for the penalties on your account, check out this article.

Step 4: Pay the Balance Due OR Seek Tax Relief

Finally, you have to figure out what to do with the amount you owe the IRS after you’ve cleared up any disagreements with them concerning the amount as well as obtained any possible penalty relief for your account.

You can, of course, pay off your balance in full. This will (obviously) stop future penalties and interest from accruing.

However, a better option — if you qualify for it — is an offer in compromise. An offer in compromise is an agreement you make with the IRS in which the IRS agrees to accept a lower amount to satisfy your tax debt than you actually owe.

That said, not all taxpayers qualify for an offer in compromise, so there are other options, such as a temporary hardship placement called currently not collectible status as well as installment agreements for taxpayers who wish to pay their balance over time.

For an overview of how tax relief works, read our article What Is Tax Relief and How Does It Work?.

What If I Already Paid the Amount on My CP91 Notice?

If you’ve already paid the amount indicated on your CP91 Notice, you can disregard the notice.

In fact, the IRS says in the “What you need to do immediately” section:

“If you’ve already paid your balance in full within the past 14 days or made payment arrangements, please disregard this notice.”

In this case, it’s possible that the IRS had already generated the CP91 Notice before it had processed your payment. This is not a big deal — it will simply take the IRS a few days (or even a couple weeks) to catch up.